In March this year, I was expressing my fears that the EU, once at the forefront of R&D on Sustainable Aviation Fuels (SAF) and now the first region in the world to consider mandatory incorporation in commercial aviation fuel from 2025, may turn into a SAF consumer area in the next decades when SAF becomes mainstream and is traded as any other commodity. I blamed this possible unfortunate fate on too severe regulatory sustainability criteria, first and foremost on raw materials eligibility, compared to the situation prevailing in the U.S. centered on the IRA momentum.

There may be more headwinds for the nascent SAF production industry of the EU: unipolarity.

Foreign Affairs published on April 18 a quite interesting article titled “The Myth of Multipolarity”, where authors Stephen G. Brooks and William C. Wohlforth posit that the U.S. remains unchallenged when it comes to unipolarity or global leadership, in spite of the current fragmentation of the world into regions of influence, some with large and increasing economic strength like China, some with a capacity for trouble, like Russia. This leadership, that started after WWII and was comforted once Soviet Union collapsed in the 1990s, can also be felt in aviation. Consider these facts:

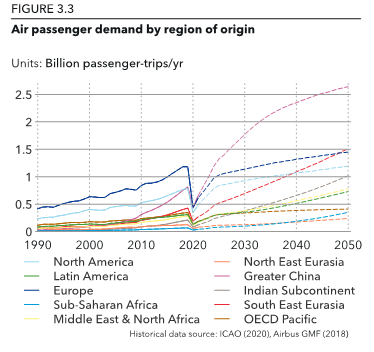

On technical issues. Boeing is still one of the two leaders in airframe construction for civil aviation, as are General Electric with its CFM International JV with Safran and Pratt & Whitney in engine construction. As their European competitors, Airbus, Safran or Rolls-Royce, these manufacturers are mostly exporters as local markets, the U.S. or the EU, are not as buoyant as Asia, where most of the growth in air traffic, thus in airplane sales, is expected in the next decades.

Several countries such as Brazil, Canada, China and Russia have encroached on this US-EU leadership in airplane construction with limited success so far. Aviation is a global activity where safety is primordial (no parking in the sky). Thus, any new piece of equipment requires a rigorous certification of airworthiness and certification is mostly in the hands of the US-EU legacy actors.

Several countries such as Brazil, Canada, China and Russia have encroached on this US-EU leadership in airplane construction with limited success so far. Aviation is a global activity where safety is primordial (no parking in the sky). Thus, any new piece of equipment requires a rigorous certification of airworthiness and certification is mostly in the hands of the US-EU legacy actors.

On regulation. The Montreal-based United Nations agency in charge of aviation, International Civil Aviation Organization (ICAO), gathering 193 national governments to support cooperation in air transport, has adopted a Long-Term Aspirational Goal of Net Zero Emissions in 2050. This is thanks to more than 10 years of efforts led by US and EU experts in numerous working groups, linked with the aviation manufacturing and fuels industries. And remember the U.S. and the EU are the largest contributors, 46% together, to the UN budget.

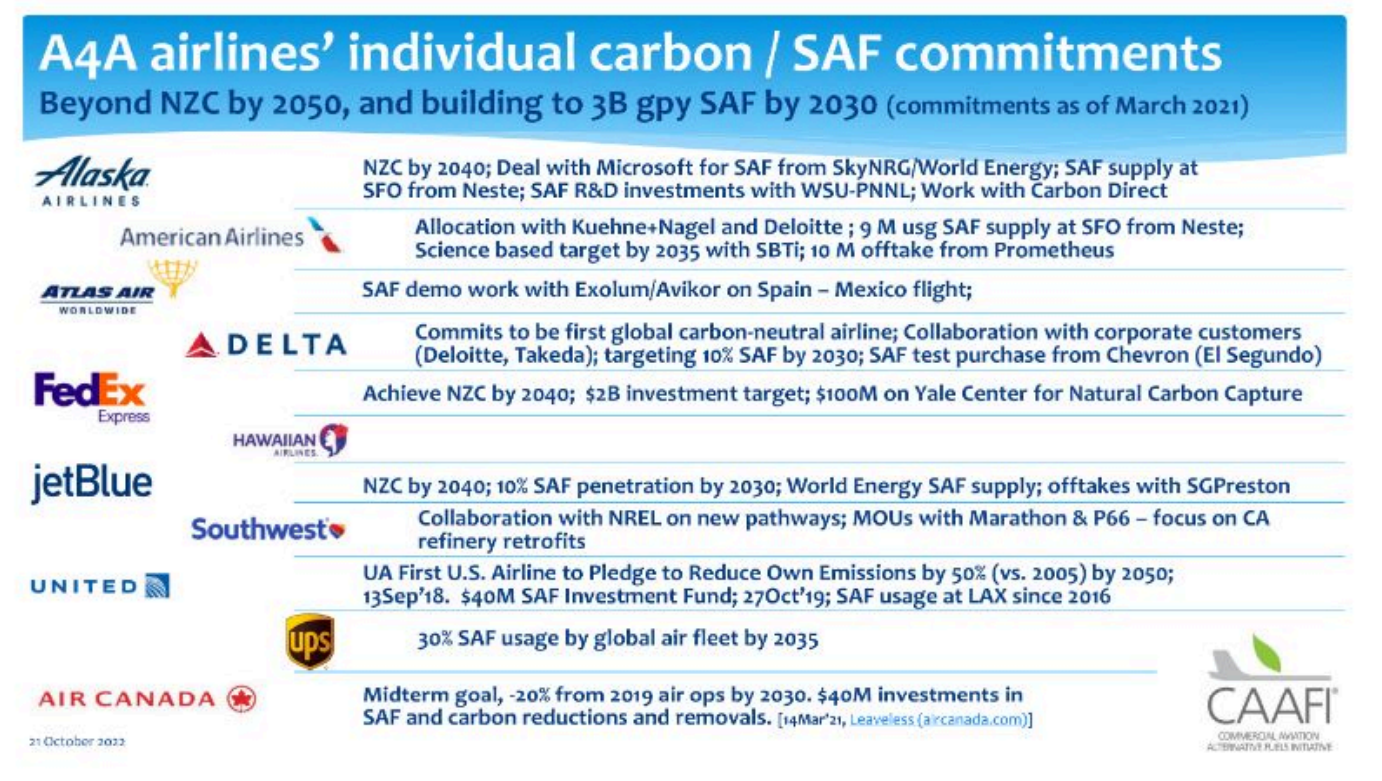

On SAF demand. U.S. airlines are dominant in the world, trusting the top three positions in terms of passengers. North America was also the only region of the world where the airlines profits were positive in 2022, according to preliminary results published by IATA, the airlines trade association, in December 2022. No surprise then that most of the SAF supply agreements, as conditional they may be, have been signed in the U.S., as can be seen in this 2022 presentation by the Commercial Aviation Alternative Fuels Initiative (CAAFI), a U.S. association that has done so much for SAF development.

And U.S. airports have not been laggards to support SAF deployment, including those in Los Angeles (LAX), San Francisco (SFO) and Seattle (SEA).

On SAF production. The U.S. has strong productive and influential agricultural and forestry industries that can deliver volumes of cost-competitive raw materials for the various SAF production certified pathways, like soy oil and corn starch. By the way, pathway certification is performed by ASTM International. Brazil and India, two major countries that can produce SAF raw materials in volumes, are mostly on the U.S. side of alliances on such matters. Membership in the Global Biofuels Alliance is a good example. Meaning the insistence in the EU to manufacture SAF exclusively from waste and residues may not stay the course beyond 2030 when SAF demand is likely to soar and competitive molecules from the West or the East of the EU are offered to airlines, global companies subject to global objectives as set by IATA or ICAO.

As John Cooper, director-general of FuelsEurope, said in a recent Transport Energy Strategies podcast, Brussels-based climate regulation may soon face some push-back from EU Member States’ industrial strategies. We could well see a global alignment of sustainability criteria for SAF, eventually. In the meantime, investors do not elbow their way to propose hard cash to put steel in the ground for commercial-size SAF production plants in the EU, and the clock is ticking for higher mandates.

Philippe Marchand is a Bioenergy Steering Committee Member of the European Technology and Innovation Platform (ETIP).