A long-standing debate between the free economy regions on each side of the Atlantic Ocean: Should innovation be supported by incentives, U.S. style, or mandates, the European way? Carrots or sticks, in short. When it comes to biofuels, the jury is still out, a strong industry having developed both in the U.S. and in the EU, its growth momentum stalled for the time being, for different reasons, too long to develop in this paper.

But the issue is back, this time to deal with the much needed development of sustainable aviation fuel (SAF), deemed essential for the future “license to fly” of air transporters, assuming growth is not tampered with by frugality, another debate. A reminder: CO2 emissions from air transport contribute a modest share of global emissions today at 3% or 6% when the estimated impact of contrails are taken into account. In a world showing a strong strategy of fast decarbonizing, the combination of business-as-usual (like using 100% fossil aviation fuel) and of a strong demand growth (CAGR of 2 to 3% per year) would make air transport the arch-villain of climate in 2050, with something like 20% of anthropic emissions.

The historic regions that developed air transport in the second half of the 20th century, North America and Europe, while not driving today the bulk of the demand growth, are at the forefront of SAF development, with aspirational objectives to reach an incorporation rate of 6 to 10% by 2030 and between 70 and 100% by 2050. SAF being more expensive than fossil kerosene, structurally rather than just for the time being, airlines will not voluntarily adopt this low-carbon version of aviation fuel without a strong public support. As aviation is a global and highly competitive sector, difficult to globally regulate, support has to take place in regions big enough to prevent airlines adopting detour strategies both in the U.S. and the EU. Each have some 20% of the global aviation fuel market and the critical size to regulate.

Enter the SAF Grand Challenge and ReFuelEU Aviation. No surprise, these regulations differ in the support approach.

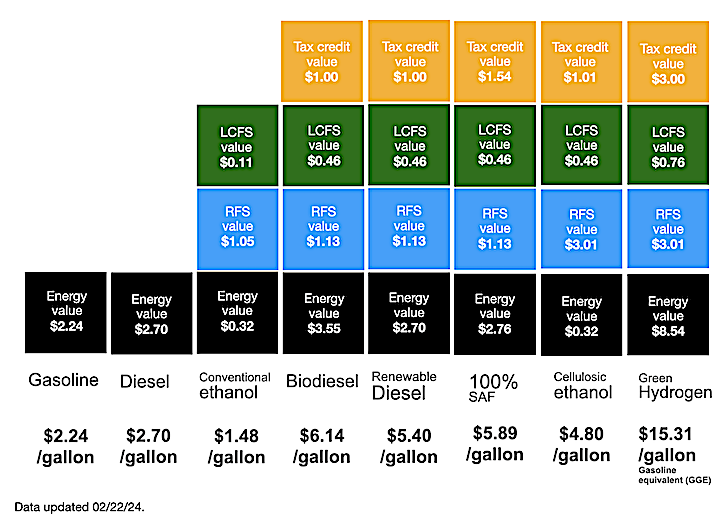

In the Land of the Free, Home of the Brave, carrots, incentives in the guise of tax credits, are offered to kick-start the low-carbon aviation fuel market, as can be seen in this daily publication, from Jim Lane’s Biofuels Digest:

Pros: incentives promote competition toward the most cost-efficient solutions.

Cons: Incentives will expire in 2027 for SAF, possibly replaced by a production credit, but are they sufficient to convince green-minded investors to sink hundreds of millions of dollars to produce 3 billion gallons by 2030, rather than, say, finance extra renewable diesel capacity? And, not to be forgotten, taxpayers somehow finance this support, even when they do not fly, and they may politically vote with their feet, in favor of climate-deniers, if they do not believe this piece of legislation is a priority, thus inserting a fragility in the regulation.

From the airlines’ viewpoint, the burden should not be too painful, during this decade at least. The most mature, most cost-competitive ASTM-certified pathway to produce SAF, lipid hydrogenation, aka HEFA, which can easily meet the 50% CO2 emission abatement threshold, can get SAF around 2.5 times the price of commercial Jet A or A1. The above figure shows SAF can be subsidized toward twice the price of fossil kerosene. What is missing in the price premium can be absorbed by a modest increase of the plane ticket, less than 2 bucks for a thousand-mile air trip on a modern airplane using 10% of this SAF. Much less than the typical variation of Jet A or A1 price, due to the hectic behavior of crude oil prices.

So, the big question is: Will SAF incentives be attractive vs other low-carbon alternatives to kick-start the market, a production issue?

On the Old Continent, sticks-style legislation is favored.

Pros: If the penalty for non-incorporation is high enough (it is: twice the price of SAF and obligation to incorporate the missing volumes during the next fiscal year), nudge (push) comes to shove for the obligated parties, airlines or aviation fuel suppliers, to meet the mandate and, lo and behold, the SAF production and usage market is thus created, CO2 emissions are reduced, all the more as the abatement threshold is high, and air travel becomes more climate-acceptable.

Better, ReFuelEU Aviation features a trajectory of steeply increasing incorporation rates (like 6% in 2030, 15% five years later, and so on to 2050, hockey-stick style), a long-term commitment to increased SAF demand, logically what investors love. Finally, on top of that, the polluter, the air traveler, pays for his/her CO2 emissions as obligated parties, facing scant profitability in this sector, in Europe at least, will pass on most, if not all, of the extra cost onto the airfare.

Cons: Mandates provide no incentive to be cost-efficient, order of merit profitability and solution technological maturity are the name of the game for swashbuckling SAF producers, scrambling to secure feedstocks and produce ASAP. On top of that, a time risk exists with mandates, in case the solutions are not fully mature to meet demand when it is imposed, a weakness financing experts are quick to point at, along with the proverbial unreliability of EU regulations with time, to justify their reluctancy to loan the huge sums needed to create the production capacity, a lengthy process of 5 to 6 years for emerging technologies.

And let us take another long look at airlines. As said above, the air travelers will eventually pay for climate-friendly fuels. But for a few hundred Euros provided by the EU ETS cap-and-trade regulation, most of the price premium between SAF and fossil kerosene will be paid by the end-user. Using the same math as above, the average air fare in Europe may be increased by 5 Euros. Not much, would you say, but we are talking of this decade, and the incorporation mandate strongly jumps beyond 2030.

Not only will this impact the airfare, but feedstock supply limited HEFA will have to be complemented by less cost-efficient pathways, which multiplier to fossil kerosene can reach 5 to 10. In 2035, with a 15% mandate and SAF at 5 times the price of Jet A1, the 5 Euros “climate surcharge” becomes 25 Euros. There is a limit to the price-demand elasticity and it becomes obvious airlines will start shedding unprofitable routes, losing market share to other transport modes, other regions or airlines not submitted to such a burden. Freedom of circulation of people, a key feature of the 20th century civilization exemplified by mass tourism, would suffer and a political backlash would not be impossible.

Mandates are great to kick-start a market, but may become a business killer when escalating too quickly, a demand issue. And a potential catch-up situation in terms of technology development to commercial scale.

Philippe Marchand is a Bioenergy Steering Committee Member of the European Technology and Innovation Platform (ETIP).