The second-hand market has been in the front seat of individual mobility for quite some time now. In France, the ratio of sales between new and second-hand cars is around 1:3, fueled by the rise of short-term leasing and the importance of corporate purchases, the latter representing one half of the new car business. In other words, whether individuals change models, once the lease has run its course, or companies renew cars, with serious fiscal incentives for low-emission models to their employees as part of their compensation package, the second-hand market gets more and more supplied with three-year old vehicles. These are significantly price-discounted and feature a lowish mileage, thus hopefully bearing a serious life expectancy, which can then appeal to motorists that do not have the financial strength to purchase a new car.

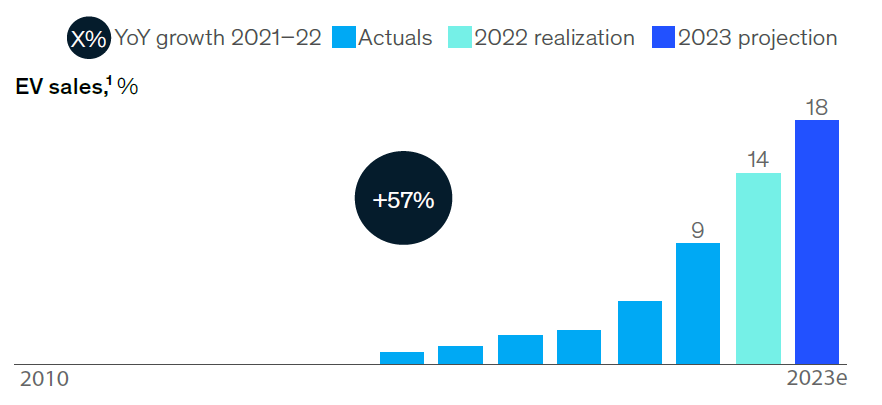

Meanwhile, in just a few years, sales of electrified vehicles, battery electric (BEV) and hybrids (full, HEV, and rechargeable, PHEV), have dramatically taken off as can be seen in the graph below, courtesy of McKinsey & Company’s Global Energy Perspective 2023, and have taken a significant share of the global market, now beyond 70 million vehicles per year:

Source: McKinsey, 2023

2023 has been a bit bumpier for the electromobility success story, and 2024 may be as well, as public support flows and ebbs, as inflation and interest rates stay along, as car prices keep on increasing. It is no surprise, then, that the second-hand market for electrified vehicles is emerging. In France, electrified vehicles accounted for 9% of the second-hand market in 2023, more than half non-rechargeable hybrids, but still 2% for each category of BEV and PHEV.

Which begets the obvious question: Will the second-hand market be one of the main tools for the massification of electromobility?

Not so soon, though. As for brand new vehicles, similar obstacles block the way:

Price, first. Maybe as a consequence of scarcity, the average price of second-hand electrified models is still significantly higher than for thermal vehicles, 33 grand for a BEV v. 20 for a gasoline-powered car. Or 22 for a diesel-powered car, still popular in non-urban areas, not concerned by low emission zones present and future diesel bans and with a good image of durability and low operating cost. Good ol’ diesel is not dead yet.

Recharge and range anxieties, next. Whether in France or in the U.S., opinion polls concur: 40% of respondents, including present “electro-motorists”, are not convinced that either recharging infrastructure or autonomy are on par with the existing state-of-the-art of the internal combustion engine vehicles (ICEV) ecosystem. Consequence: These are likely to wait and see before crossing the Rubicon to BEV, or will go halfway, toward HEV first, PHEV possibly, both relying on a thermal engine as a solace to autonomy anxiety.

Regarding range per se, it seems the more carmakers boast about progress, battery-wise mostly, the more incumbent motorists ask for more.

Location and ubiquity of recharge, a proxy for cost and competitiveness vs thermal vehicles, and for non-availability of the car, may also prove a near-future hurdle: cheap home-charging (but for how long? Check what happened last November in Connecticut when reality struck that liquid fuel taxes would somehow evaporate) was the fate for most early adopters, less likely to be the dominant model if urbanites or condo dwellers purchase BEVs.

Repairability and battery end-of-life, finally: Several media have been showing scary footage of huge BEV graveyards in China, battery problems not being minor in the decision to wreck those recent vehicles. ICEVs nowadays are resilient and a three-year old car is nearly as good as new when it comes to life expectancy. Is it the case for electrified vehicles, especially considering battery life, a big unknown with little to show in terms of experience curve? Not mentioning the present attitude of insurance companies, systematically recommending scrapping in case of accidents with possible shocks to the battery.

Can climate consciousness, in areas where electricity can really be low-carbon, temporary lower total cost of operation and the fear of low emission zones bans erase these worries? Time will say. For the time being, we note the nascence of a second-hand market for electrified vehicles, another prop for the massification of electromobility.

Philippe Marchand is a Bioenergy Steering Committee Member of the European Technology and Innovation Platform (ETIP).