Here’s my monthly take on the five most interesting developments in transport energy trends, now just for Transport Energy Outlook members. What I try to do each month is select stories, studies, and other interesting items that you may not have seen elsewhere but that really represent an important issue or trend that I think you would want to know about. Or I try to poke behind the hype to provide a deeper understanding of what’s happening. Items I selected this month include:

1. IEA: The Energy World Is Set to Change Significantly by 2030 – The latest edition of the World Energy Outlook (WEO) describes an energy system in 2030 in which clean technologies play a significantly greater role than today. This includes almost 10 times as many electric cars on the road worldwide; solar PV generating more electricity than the entire U.S. power system does currently; renewables’ share of the global electricity mix nearing 50%, up from around 30% today; heat pumps and other electric heating systems outselling fossil fuel boilers globally; and three times as much investment going into new offshore wind projects than into new coal- and gas-fired power plants.

All of those increases are based only on the current policy settings of governments around the world, IEA found. If countries deliver on their national energy and climate pledges on time and in full, clean energy progress would move even faster. However, even stronger measures would still be needed to keep alive the goal of limiting global warming to 1.5 °C.

IEA notes that the combination of growing momentum behind clean energy technologies and structural economic shifts around the world has major implications for fossil fuels, with peaks in global demand for coal, oil and natural gas all visible this decade – the first time this has happened in a WEO scenario based on today’s policy settings. In this scenario, the share of fossil fuels in global energy supply, which has been stuck for decades at around 80%, declines to 73% by 2030, with global energy-related CO2 emissions peaking by 2025.

Despite current geopolitical friction, volatile commodity prices and uncertainty around costs, transformative changes in parts of the global energy system are coming into view, IEA notes. Their evidence? EVs account for around 15% of car sales today and are on course to reach a share of 40% by 2030 in the Stated Policies Scenario (STEPS). (These are the policies that have already been enacted and promulgated.) Much of this growth will come from China and the EU. A record 220 gigawatts (GW) of solar capacity was added in 2022, and deployment levels are projected to more than double, while heat pumps more than double their share of heating equipment sales in the STEPS by 2030.

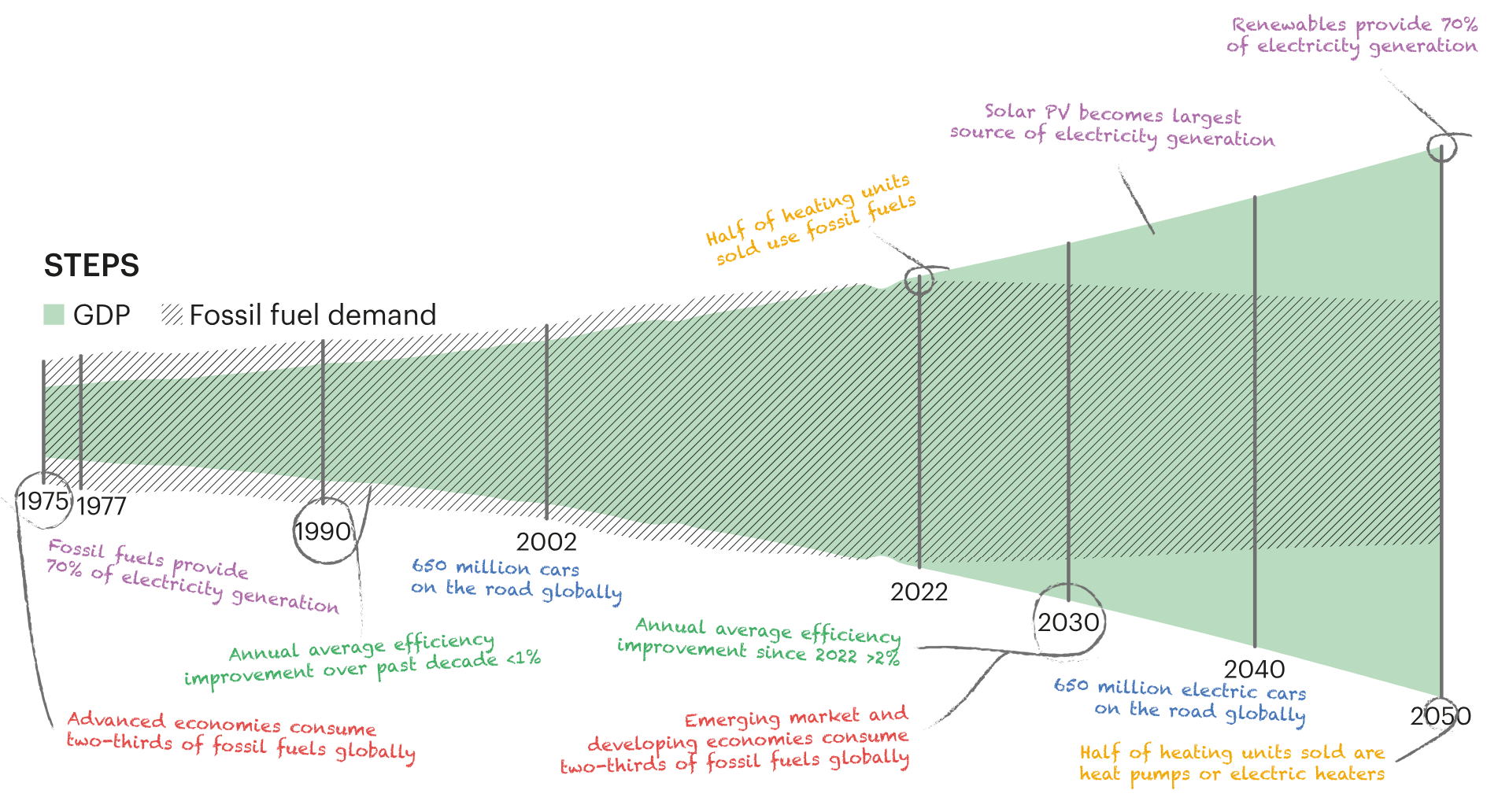

The planned boost in the manufacturing capacity of these clean energy technologies, if fully realized, appears able to meet many of the deployment milestones in the Announced Pledges Scenario (APS) and, in the case of solar and batteries, also to provide what is required in the IEA’s Net Zero Emissions by 2050 (NZE) Scenario. The figure below shows how these developments are projected by IEA to play out through 2050.

Figure 1: Transformative Energy Changes through 2050 as Projected by IEA

Source: IEA, November 2023

What about transport specifically? In the STEPS, the global car fleet increases by over 15% by 2030, and a similar increase is projected for buses, according to IEA. The fleet of two/three-wheelers increases by over 20% and the number of trucks by over 10% over the same period. Aviation activity doubles from today’s level, rail passenger-kilometers increase by 36%, and shipping ton-kilometers increase by almost 20% in 2030.

In the APS, modal shifts away from private transportation lessen the growth of the car fleet and lead to rail passenger-kilometers being over 5% higher in 2030 than in the STEPS. In the NZE Scenario, stronger measures to minimize emissions reduce the activity in aviation by 20% and the car stock by 15% compared to the STEPS in 2050: these measures include behavior changes and the expansion of high-speed rail.

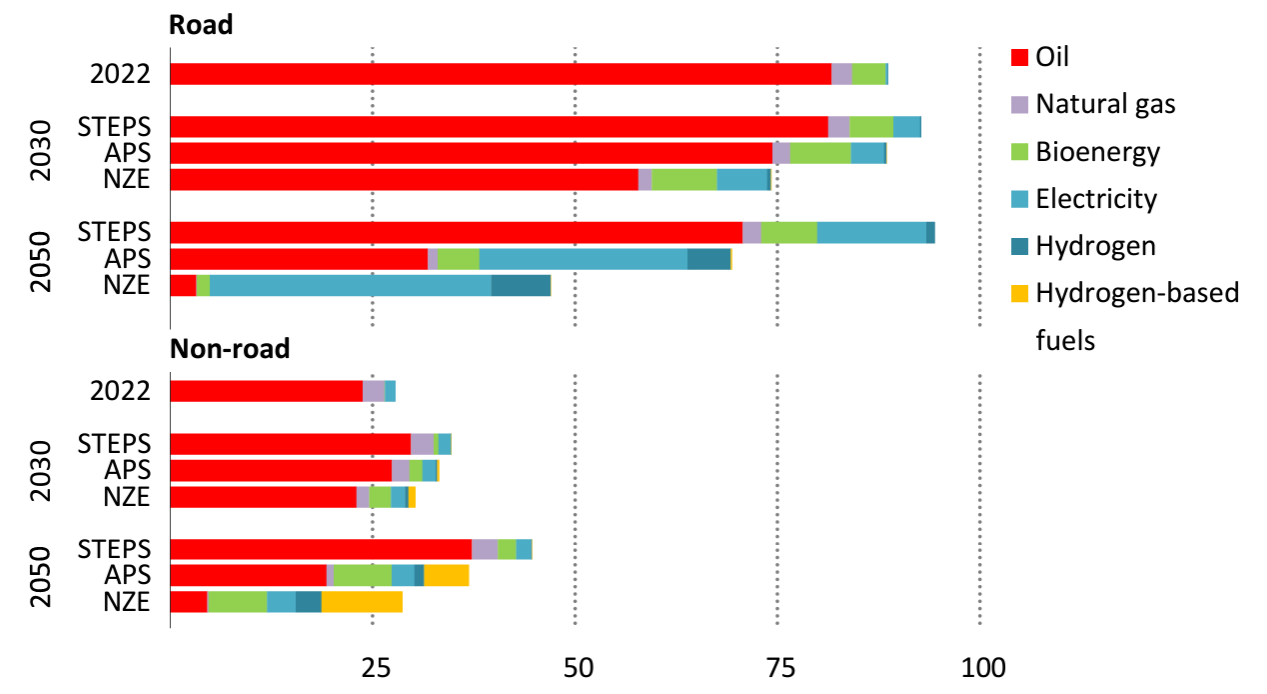

By 2030, the share of oil in road transport energy demand drops from 92% today to 88% in the STEPS, 84% in the APS, and 78% in the NZE Scenario, shown in Figure 2.

Figure 2: Energy Demand in Transport by Fuel and Scenario, 2022-2050

Source: IEA, November 2023

A “tectonic shift” towards electromobility and the increased use of biofuels drive this drop, according to IEA. Electricity demand for road transport rises by more than 12-times by 2030 in the STEPS and over 15-times in the APS. Supported by phase-out dates for internal combustion engine vehicles (ICEVs) and incentives for electromobility, EVs account for nearly 20% of total road vehicle-kilometers in the APS in 2030. However, since they are three- to four-times more efficient than ICE vehicles, they only account for 5% of road transport energy demand.

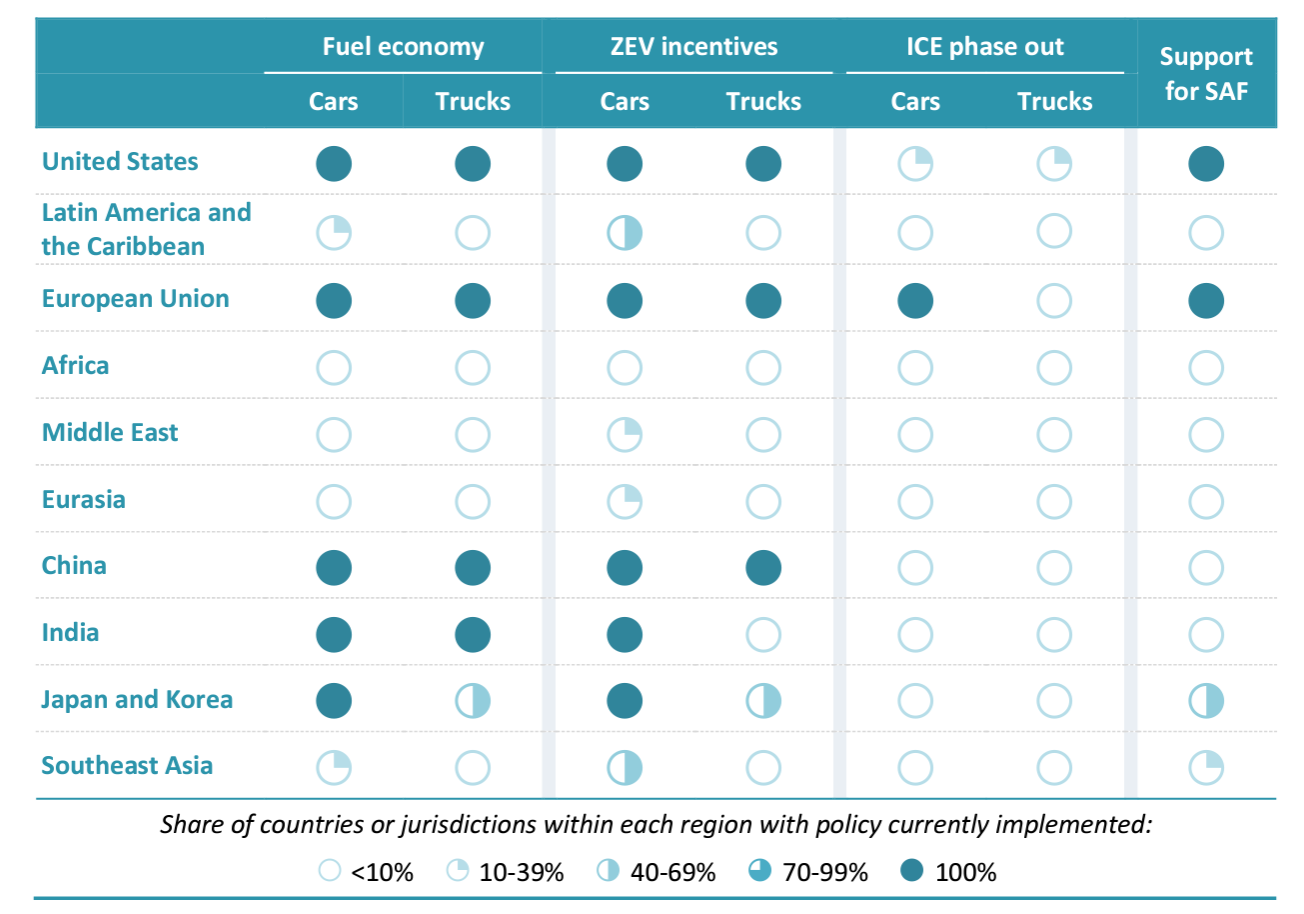

Figure 3: Key Energy Demand Policies for Transport By Region

Source: IEA, November 2023

What about aviation, the primary focus of current research for members? IEA notes a variety of parallel strategies are needed to decarbonize aviation. Improvements in aerodynamics and lightweighting materials have led modern airplanes to be nearly 20% more efficient than those built around a decade ago. There will be further improvements to come, but technology, material and design changes in aeronautics are characterized by long implementation times.

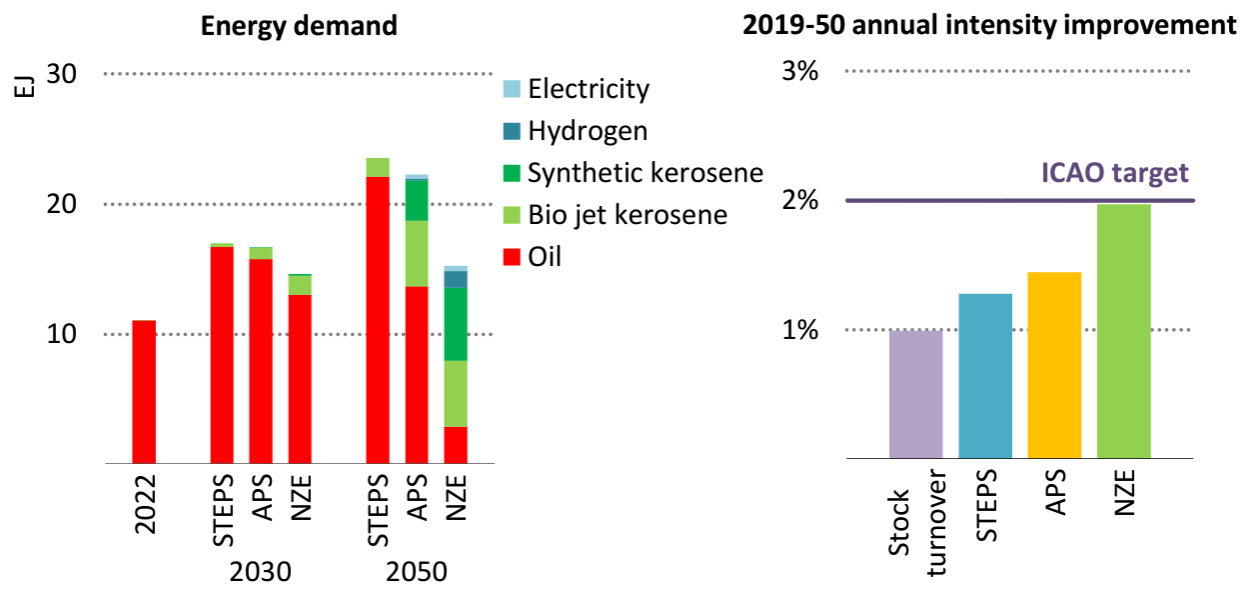

Sustainable aviation fuels (SAF) offer scope to replace oil and reduce emissions, but they are still very expensive and today represent less than 0.01% of energy demand in aviation, according to IEA. In the NZE Scenario, behavior changes are another key lever, without them, total aviation activity would be 10% higher by 2030 and over 20% higher by 2050. Figure 4 shows energy demand in aviation by fuel and scenario through 2050.

Figure 4: Energy Demand in Aviation by Fuel and Scenario, 2022-2050, and Annual Fuel Intensity Improvement Rate, 2019-2050

Source: IEA, November 2023 Note: ICAO= The International Civil Aviation Organization (ICAO), which set an aspirational goal in 2010 to improve fuel intensity (measured per revenue ton-kilometer) by 2% per year to 2050.

With respect to SAF, IEA notes that:

…”efficiency improvements have a very important part to play, but they offer only a partial answer to the problem of aviation emissions. They cannot even entirely counterbalance growth in demand for aviation, which is expected to lead to an increase of around 4% in flight activity each year until 2050. This points to an urgent need for the development and deployment of lower carbon fuels.”

SAF look to be the most promising option, IEA notes, but high costs remain a barrier to widespread adoption, and the announced project pipeline covers only 1-2% of global aviation demand by 2027. In the STEPS, biojet kerosene makes up 2% of total energy demand in aviation in 2030 and 6% in 2050, compared with over 5% and 37% respectively in the APS, and 11% and 70% respectively in the NZE Scenario. Synthetic kerosene demand in 2050 in the NZE Scenario is nearly double the levels in the APS. The higher levels of demand in the APS and the NZE Scenario assume higher levels of support for SAF from governments and increased industry investments in the context of broader policy frameworks that give a high priority to reducing emissions.

As an answer to the “feedstock crunch” hampering SAF market growth, IEA suggests:

“To meet additional biofuel demand over time, alternative production pathways using materials such as municipal solid waste and agricultural and forestry residues need to be commercialised. Government support and private investments are also needed for the development and commercialisation of SAF technologies that have low technology readiness and high costs today, notably synthetic kerosene.”

2. Bloomberg: China’s EV Makers Want Top Oil Producing Nations to Go Electric – With EV demand slowing in China, and companies facing substantial import tariffs in the U.S. as well as an EU probe into Chinese subsidies, the country’s automakers increasingly view the Middle East as a major growth opportunity that, so far, is largely untapped. According to this article from Bloomberg, across the six Gulf states, including oil majors Saudi Arabia and the United Arab Emirates (UAE), electric cars account for just 0.4% of the passenger-vehicle market.

That’s got some of China’s best-known automakers flocking to the region. Chery Automobile Co. is planning to launch at least two new hybrids or EVs, while Xpeng Inc. and Zhejiang Geely Holding Group Co.’s premium Zeekr brand have started selling in Israel and making plans to expand into more countries in the region, including Qatar and Bahrain. But there are headwinds, similar to other regions: Lack of consumer awareness, charging infrastructure, vehicle costs and cheaper, subsidized fuel, among other reasons. Still, it’s considered a growth market because wealthy customers are interested in EVs with innovative in-car technologies and can rapidly accelerate like a Porsche. Moreover, customers now see Chinese vehicles as durable, reliable, and with capabilities on par with German, American or Japanese cars that make them worth the money.

Meantime, several Middle Eastern countries are getting involved in the space. The UAE is investing as much as 200 billion dirhams ($55 billion) by 2030 to transform its energy strategy, and has pledged that EVs and hybrid cars will make up more than 50% of the national fleet by 2050, from 4% currently. Saudi Arabia this year greenlit a manufacturing plant for Ceer, its first homegrown EV brand that’s set to start selling cars in 2025, and recently opened another with California-based maker Lucid Group Inc. The kingdom has already signed a $5.6 billion deal with premium Chinese automaker Human Horizons Technology that reflects the region’s interest in higher-end vehicles. Separately, the Abu Dhabi government this year took a 7% stake in China’s Nio Inc.

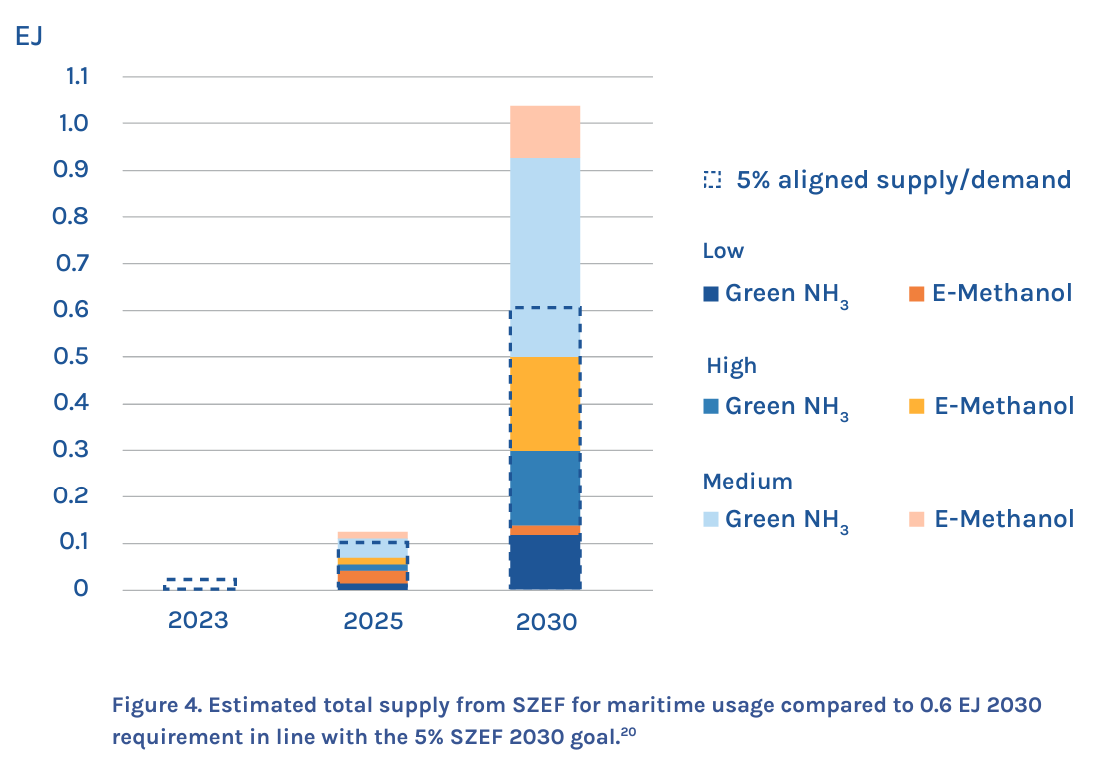

3. MarineLink: Shipping Industry Off Track to Meet 5% Zero-emission Fuel Target by 2030 – According to a new analysis from the consultancy UMAS, the world is not on track for zero-emission fuels to account for 5% of international shipping fuels by 2030, jeopardizing the shipping industry’s overall 2050 decarbonization goal. Launched at the Global Maritime Forum’s annual summit in Athens late last month, the assessment finds that current scalable zero-emissions fuel (SZEF) production in the pipeline would cover just a quarter of the fuel needed by 2030. This is shown in the figure below.

Figure 5: Estimated Total Supply from SZEF by 2030

Source: UMAS, October 2023

According to the analysis, 5 to 10% of the fuel demand for shipping in 2030 would amount to about 5.3 million metric tons of hydrogen, 29.8 million metric tons of ammonia, or 28.1 million metric tons of methanol. Moreover, it is estimated that the industry will have to invest about $40 billion annually in SZEF bunkering and production.

This year, the International Maritime Organization revised its GHG strategy, outlining the 5% goal but noting the industry should strive to achieve 10% zero-emission energy in international shipping fuels by the end of the decade.

4. Euractiv: Biofuels Industry Criticises ‘Inconsistent’ Transport Decarbonisation Policy – A European Commission report analyzing the achievement of the 2020 Renewable Energy Directive (REDI) goals found that the consumption of biodiesel and bioethanol has increased since 2016 and contributed to GHG emissions reduction, with bioenergy the primary means to decarbonize the EU transport sector at present. The report noted that, “Consumption of food and feed crop based-biofuels continues to represent a large share of renewable energy consumption in transport while the consumption of advanced biofuels was lower but increased significantly in recent years…”

Euractiv notes that despite EU legislation sanctioning the use of first-generation biofuels to replace petrol and diesel for road vehicles, both bioethanol and biodiesel are considered similar to fossil fuels in legislation governing aviation and maritime fuels. The biofuels trade group ePure, called out the contradiction telling Euractiv:

The revised [REDIII] confirms the sustainability of crop-based biofuels including renewable ethanol and gives member states the flexibility to use them to meet transport de-fossilisation goals…but other EU legislation in ‘Fit for 55’ marginalises or even prohibits the contribution of these sustainable biofuels to achieving climate goals.”

Under REDIII, the biofuel cap remains unchanged. As in the previous version of the law, the contribution of crop-based biofuels to road and rail transport renewable energy targets is capped at 7% of the total. Countries may also not go beyond a 1% increase compared to 2020 levels. The biofuels industry has pointed to policymakers’ unwillingness to revise down the 7% cap as confirmation of “the sustainability and importance” of crop-based biofuels.

Moreover, Euractiv notes, despite a strong NGO campaign, the breadth of permitted crop-based biofuel feedstocks also remains unaltered. At present, only palm oil is set to be phased out as a fuel feedstock by 2030. In the run-up to the REDIII revision, NGOs mounted a campaign for soy to be added to the list of restricted feedstocks, arguing that it contributes to the clearing of land in Latin America. They weren’t successful, and soy remains below the level that would require the biofuels industry to phase it out.

5. Axios: Biden’s Big Bet on Hydrogen Has Potential Warming Pitfalls – As members know, the Administration, through the U.S. Department of Energy (DOE), recently announced its US$7 billion investment through the Inflation Reduction Act (IRA) in creating regional hydrogen hubs (see post Oct. 18, 2023). However, and as noted in this Axios story, there are two major “red flags”:

EDF noted to Axios that: “Preventing leaks and unnecessary venting is essential. Hubs need both strategies and technology to prevent emissions, including a new generation of sensors coming to market to find and fix problems.”