April is the month of the Chinese Motor Show every year, in Beijing or Shanghai, the last global event of the car manufacturing ecosystem that seems to have some traction for an industry that is facing a paradigm change, from the race for volumes to a real-time materials-dictated volume adjustment. This motor show takes place in the largest marketplace for new cars, in the second most populated country in the world, now that China has been overtaken by India, on headcount, not wealth. There were 23 million new car sales last year in China, compared to 13 million in the U.S., much less in any other country. And this motor show is now about electromobility: last year, one quarter of sales were fully electric (EV) or hybrid, which placed China top of sales for electromobility, in volumes, Norway keeping the pole position in percentage of sales.

Norway: cynicism would allow the comment that sales of oil and gas from the North Sea create generous dividends to subsidize EV purchasing, honesty would recognize electricity in Norway is really low-carbon and renewable, which is a prerequisite for electromobility to decarbonize road travel.

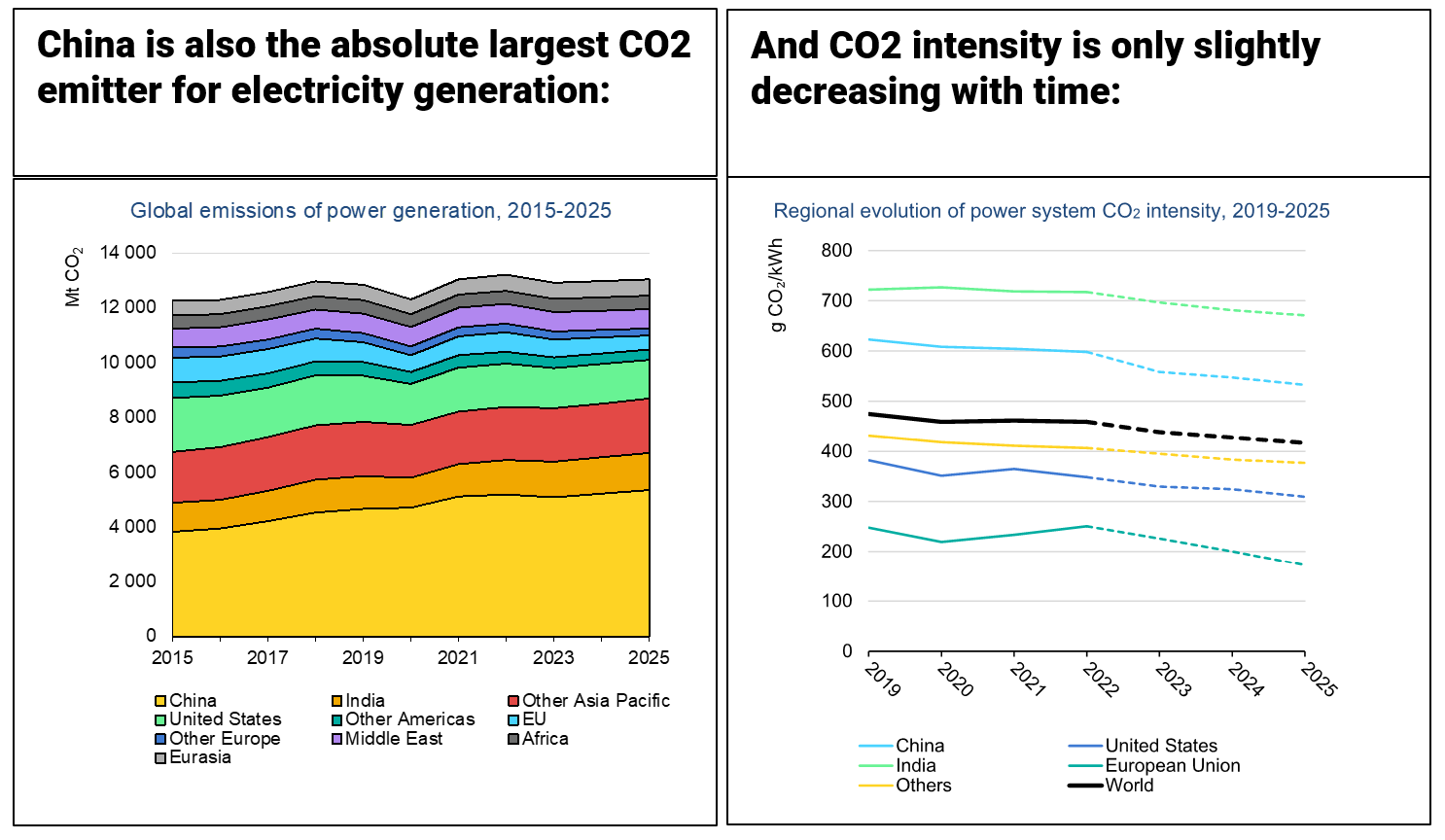

Which is the apparent paradox in China, where electricity is not low-carbon: the CO2 intensity is still higher than 600 gCO2/kWh, having only slowly decreased in the last few years, the additional electricity generation capacity being slightly more based on renewables than on coal. The EU is at 250, the USA at 350 as the chart below shows.

Source: IEA Electricity Market Report, 2023

Air quality (and noise) improvement may have been an important driver behind the rise of electromobility in notoriously polluted Chinese metropolises, but the negative consequences on CO2 emissions are undeniable. A full lifecycle analysis, cradle-to-grave, conducted by the French research center IFPEN in 2022 showed the total CO2 emissions for a C segment (mid-size sedan), 420 km autonomy, EV, in real driving conditions (WLTC), recharged with an electricity at the Chinese intensity level, would be higher by 10% than its equivalent petrol-powered model. Electromobility only makes sense when electricity is low-carbon, from the planet point of view at least.

Looking further out to globalization fading momentum and tense geopolitics, one can suspect China has found a way to monetize its initial ambitious strategy to develop EVs. When the post-pandemic world gets even more wary of consequences of local war theaters, Ukraine today, Taiwan tomorrow (?), and talks about re-shoring, re-industrialization, to improve supply security, why not be appealed by the call of open markets? For example, like the EU, the self-proclaimed champion of the fight against climate change, looking for magic solutions like electromobility, having learned no lesson whatsoever from its historic energy dependence (and transport needs energy)?

In the democratic West, where industrial innovation can only come, slowly, too slowly, from market forces, short-term orientated and notoriously short-sighted when it comes to long-term trends, autocratic export-orientated countries like China can find an inexhaustible source of new markets, profitable and creating a renewed dependence, for batteries or their components. And this is what we see today in Europe.

Legacy carmakers in the EU are eyeing the luxury segment (VW and Mercedes launched two top-of-the-range models at the Shanghai Motor Show) and some are beginning now to reorganize their manufacturing chains toward electromobility (no finger-pointing). Meantime, the Chinese EV manufacturers recently created from “a fever hotter than a pepper sprout” (credits to Johnny Cash and June Carter Cash), BYD a good example, are beginning to swamp the European market with more affordable EVs with price tags around 30,000 Euros with subsidy. The present offer for EU manufacturers is rather beyond 40,000 for a mid-range electric sedan, well above the affordability level for most motorists.

We got the Japanese cars in the 1970s. We may now get the Chinese EVs. Is that the way to re-industrialize Europe? This is how it will be unless a gross word, protectionism, makes a successful comeback. Limiting the attribution of EV purchase subsidies to models with a low-enough manufacturing carbon footprint, de facto excluding imports from countries where energy used in industry is high-carbon, like China, may be the way. France is at the forefront of this new norm-based protectionism, and Brussels seems to listen. Better late than never.

Philippe Marchand is a Bioenergy Steering Committee Member of the European Technology and Innovation Platform (ETIP).