Hello friends! Here’s my monthly take on five most interesting developments in transport energy trends. What I try to do each month is select stories, studies and other interesting items that you may not have seen elsewhere but that really represents an important issue or trend that I think you would want to know about. Or I try to poke behind the hype to provide a deeper understanding of what’s happening. Items I selected this month include:

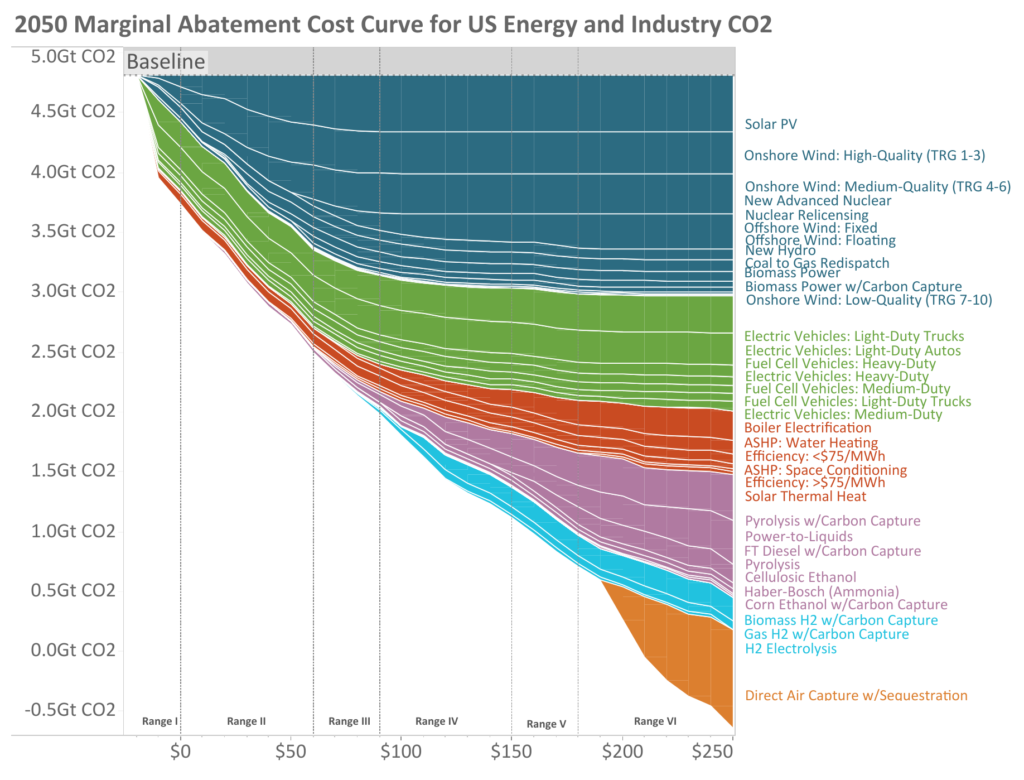

1. Climate Tech VC: MACCing on Marginal Abatement Cost Curves – This article, from a great newsletter on climate tech venture capital I found recently on Substack, goes deep into marginal abatement cost curves (MACC), originally developed by McKinsey in the early 2000s. Using the latest energy models, the Environmental Defense Fund (EDF) teamed up with Evolved Energy Research to (literally) flip the McKinsey MACC on its head and create a roadmap for policymakers and innovation investors alike to drive U.S. energy and industrial carbon dioxide emissions to zero by 2050.

Source: Evolved Energy Research as cited in Climate Tech VC, April 2022

It’s a U.S.-based analysis, sure, but I think it has global implications, too. From the transport energy perspective, the abatement measures delivering the most GHG reductions for the cost appear to be light and heavy duty EVs and fuel cell vehicles across all classes. Other transport technologies analyzed include pyrolysis with carbon capture, power-to-liquids (PtL or electrofuels) and Fischer-Tropsch (FT) diesel with carbon capture. Also noted, interestingly, was cellulosic and corn ethanol with carbon capture though the GHG emission reduction abatement is much less than the other options. Outside of FT, there is no mention of other technologies being heavily invested in and scaled up right now: other biomass-based diesels (particularly HVO) and biomethane.

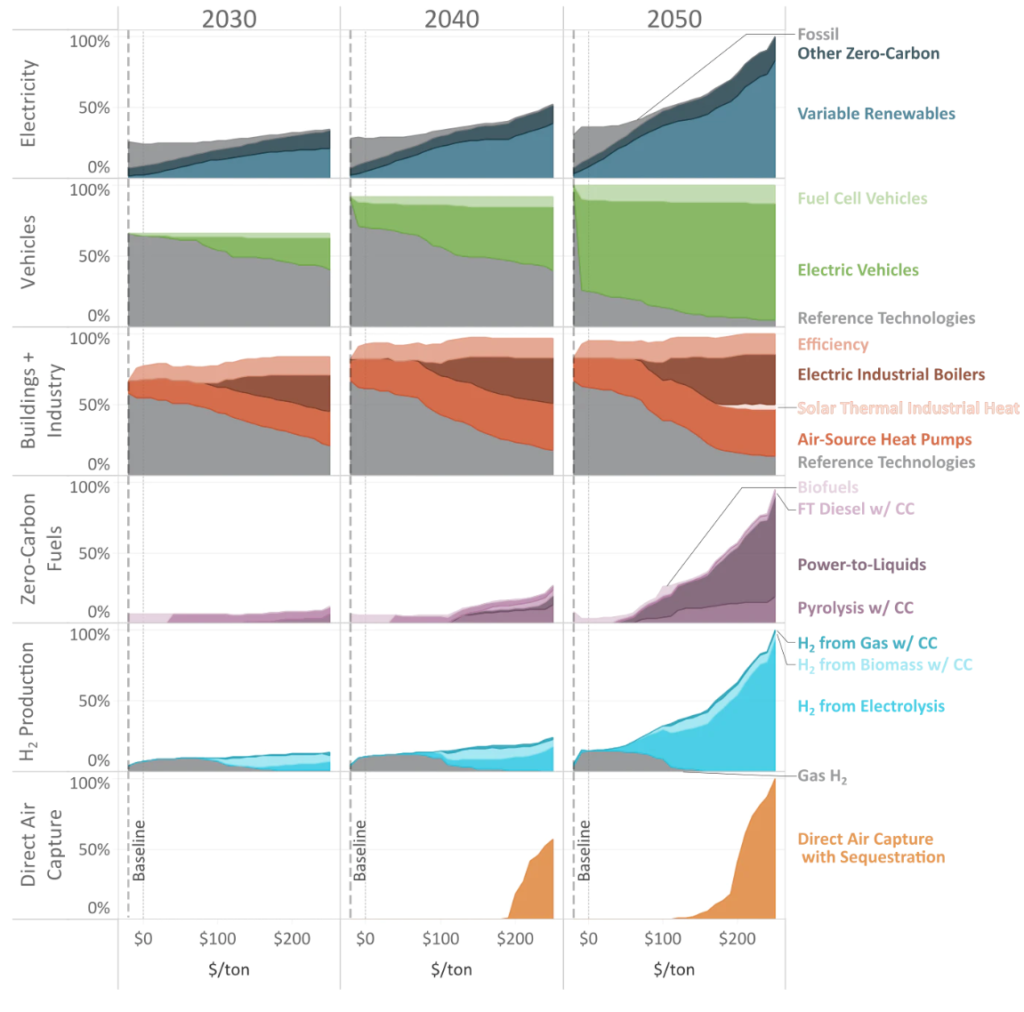

The EDF-Evolved Energy Research “MACC 2.0” model charts out the trajectory of some technologies through 2050, shown in the figure below. The X-axis is the same marginal abatement cost as in the first MACC figure, and the Y axis shows the deployment levels normalized at 100% to demonstrate the relative scale of change. Not every abatement solution was included in the analysis. The modeling suggests a 50% deployment of EVs in 2040 and near 100% in 2050. PTL begins a major scale up after 2040 as does hydrogen from electrolysis. Biofuels, as a subset of zero carbon fuels, remain small by 2050.

Source: Evolved Energy Research as cited in Climate Tech VC, April 2022

2. Euractiv: Europe Rediscovers Biogas in Search for Energy Independence –With the war in Ukraine raging on and the need to reduce the EU’s dependence on Russian gas has vaulted biogas to the fore within the European Commission. The gas legislative package presented by the Commission last December “would not have been a priority for the French EU Council presidency,” one expert notes to Euractiv. But that’s changed now. The Commission and Member States are looking at scaling up biogas “with renewed interest.”

The legislative package presented in December proposed, among other things, to facilitate the adoption of renewable gases “by removing tariffs for cross-border interconnections and lowering tariffs at injection points.” The aim is to guarantee access for these gases to the wholesale market and establish a certification system for low-carbon gases.

One of the issues in the legislative package as presented is the lack of clarity and methodology for defining – and differentiating – between the different types of green and low-carbon gases, which critics say risk holding back investments. Currently, any gas produced from renewable energy resources is considered renewable, including biogas produced from the fermentation of organic matter and biomethane, its improved version which can be directly injected into the grid. But there are other types of low-carbon gases such as hydrogen, which can be obtained in many different ways, including renewables or fossil fuels, the article notes. Ensuring that legal definitions allow differentiating between them will therefore be crucial from an environmental perspective.

There’s no doubt about it: Biomethane and green hydrogen are high on the list of priorities in Brussels. The Commission plans to increase biomethane production to 35 billion cubic meters (bcm) by 2030, up from 3 bcm in 2020. Production should already be increased by 0.5 bcm before the end of the year. By the end of the decade, this should replace 20% of gas imported from Russia. With these new targets, around 10% of the bloc’s energy needs should be covered in 2030, according to the European Biogas Association (EBA). And if the trend continues, 30-40% of the EU’s gas demand could be covered by 2050.

3. Wall Street Journal: Revolt in Disney’s Florida Kingdom – Wait a second, you might ask, what does the tussle between Florida Governor Ron DeSantis and Disney CEO Bob Chapek over Florida’s new “Don’t Say Gay” law have to do with transport energy, fuels and vehicles? I’ll get to that, but first a little background. Readers may know and as described in this op-ed that following the law’s passage, Chapek told Disney employees the company would take no position. Employees revolted and Chapek changed his position calling Florida’s bill a “challenge to basic human rights.”

That served to irritate some Florida voters, Disney customers and most importantly, the Republican-dominated Florida legislature and Governor DeSantis. The legislature and DeSantis decided to take action by revoking Disney’s ability to completely control the 40-square mile region that is Disney World in central Florida. And they did so in just 48 hours. Chapek’s about face will end up costing the company millions at the end of the day – assuming the law is not overturned (and it could be as it does, for one thing, raise free speech concerns). The angle in the op-ed concerns the culture wars:

“There’s a warning here to other companies, especially Big Tech and Wall Street, which are mainly based in liberal states but conduct business everywhere. If they try to impose their cultural values, they risk losing Republican allies on the policy issues that matter most to their bottom lines, such as regulation, trade, taxation, antitrust and labor law. Polls show rising GOP hostility to big business, and that is likely to be reflected when Republicans take power.”

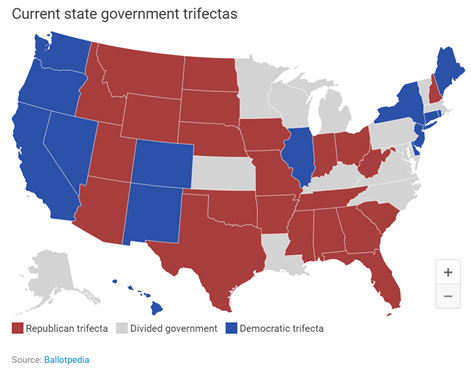

There are larger themes at play here, especially where it concerns transport energy. I am seeing a similar trend brewing in Republican-dominated states, particularly where there is a “trifecta,” when it comes to certain transport energy policies. A trifecta means the two chambers of a state’s legislature and the governorship is controlled by one party, in this case, the Republicans. The figure below shows states with trifectas.

Now, where am I seeing the influence of trifectas as well as Republican action on transport energy issues? For one thing, limited to zero support of EV targets, goals and mandates, as well as the California Advanced Clean Car program that a number of states are in the process of implementing. A similar dynamic exists for the Advanced Clean Truck program, which effectively mandates ZEVs by 2035, and low carbon fuel standard (LCFS) programs. These measures are also having difficulties progressing in states with divided governments. Republicans in some divided governments are trying to overturn or slow down the foregoing initiatives. And as I noted last month, Republican governments are pushing back on banks and their ESG-related initiatives.

The upshot to me is: With a lack of strong federal backing of climate-related transport energy initiatives coming not just from the Biden Administration but from the Congress, and most of the country either with a divided government or in a Republican trifecta, progressive policies like ZEV mandates and LCFS programs may have difficulty getting off the ground. In the larger picture, climate progress in transport energy and in general may be unnecessarily slowed and hampered.

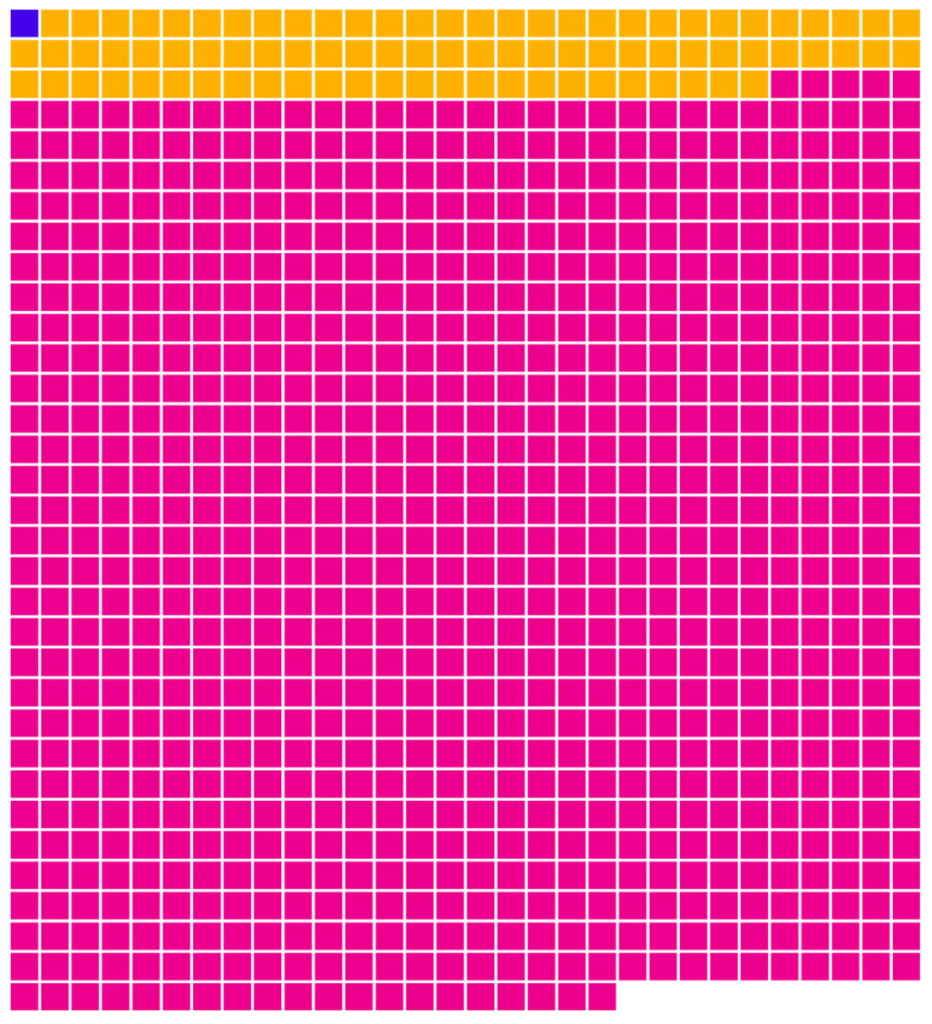

4. The Verge: Visualizing the Scale of The Carbon Removal Problem – This article notes that to get climate change under control we’re going to have to start sucking a whole lot more planet-heating carbon dioxide out of the air. And we need to start doing it fast. Two major climate reports released this month alone say we’ll have to resort Direct Air Capture (DAC) to keep our planet livable. Finding ways to remove carbon dioxide from the atmosphere is “unavoidable,” a report from the United Nations Intergovernmental Panel on Climate Change says.

There are just 18 direct air capture facilities spread across Canada, Europe, and the U.S. Altogether, the article notes, they can capture just 0.01 million metric tons of CO2. To avoid the worst effects of climate change, we need a lot more facilities with much larger capacity, according to a recent report from the International Energy Agency (IEA). By 2030, direct air capture plants need to be able to draw down 85 million metric tons of the greenhouse gas. By 2050, the goal is a whopping 980 million metric tons of captured CO2.

So, what does that look like in effect? In the image below, the blue is what one futuristic DAC plant might capture, the orange is how much CO2 needs to be captured by 2030, and the pink represents the 2050 goal for captured CO2.

Source: The Verge, April 2022

The IEA projects we’ll need to scale up carbon removal dramatically. More than 30 new DAC plants would need to be built each year, on average, to reach its 2050 goal. Each of those plants would need to be able to draw down 1 million metric tons of CO2 a year, for a total of 980 million metric tons per year in 2050. According to The Verge, what we can capture now is just one one-hundredth of that blue square. And the first plant big enough to capture as much CO2 as that blue square represents isn’t expected to come online until the mid-2020s. Speeding things up is expected to come with a hefty price tag (right now, it typically costs upwards of $600 to capture a mere ton of CO2).

5. DW: The EU’s Risky Dependency on Critical Chinese Metals – This article notes that even as the EU tries hard to cut its energy supplies from Russia, the bloc is also heavily dependent on China when it comes to the industrial metals and rare earths that the bloc needs for wind turbines, electric vehicles, solar cells and semiconductors. Today, Russia and tomorrow, China.

DW notes the EU’s dependency on metal imports is somewhere between 75% and 100% depending on the metal. Of the 30 raw materials that the EU classifies as critical, 19 are predominantly imported from China. The list includes magnesium, rare earths and bismuth where China has a de facto monopoly, providing up to 98% of the supplies needed in the EU. This dependency could even increase in the future. The EU estimates that cobalt demand alone will rise fivefold by 2030. Lithium demand is expected to increase 18-fold by 2030 and 60-fold by 2050 on the back of the bloc’s e-mobility campaign.

Potentially compounding the issue is when (probably if) China reduces its raw materials exports. DW highlights that in its latest five-year plan, Beijing made it clear that exports would be cut to satisfy growing domestic demand. Moreover, and as we know, the government is positioning itself as a technology exporter, not an enabler of the competitors’ ability to export themselves.

The article highlights Germany’s efforts to diversify its metal and rare earths imports, just as we’re seeing in the U.S. and in other countries. While Germany has been trying to develop alternative sources for years, such as from Brazil, it’s still dependent on Chinese imports. There is increased attention in EU countries on domestic mining – but that has sparked protests. Spain just experienced public protests against plans to open a lithium mine in Estremadura. Such protests also occurred in Serbia and Portugal. And European mining is not as financially competitive against China. Recycling materials may help but will not solve the problem.

Tammy Klein is a consultant and strategic advisor providing market and policy intelligence and analysis on transport energy to the auto and oil industries, alternative fuels industries, governments and NGOs. She writes and advises on petroleum fuels, biofuels and other alternative fuels, and fuels policy, market and technology issues.