Hello friends! After a little break, I’m back at it with my monthly take on the five most interesting developments in transport energy trends. What I try to do each month is select stories, studies and other interesting items that you may not have seen elsewhere but that really represents an important issue or trend that I think you would want to know about. Or I try to poke behind the hype to provide a deeper understanding of what’s happening. Items I selected this month include:

1. Inside Climate News: US Emissions Surged in 2021: Here’s Why in Six Charts – U.S. carbon dioxide emissions boomeranged toward pre-pandemic levels in 2021, a turnaround from more than a decade of downward trends, and freight transportation and coal are major culprits, according to a report recently released by the Rhodium Group. U.S. GHG emissions grew 6.2 percent last year as the American economy largely recovered from pandemic lockdowns.

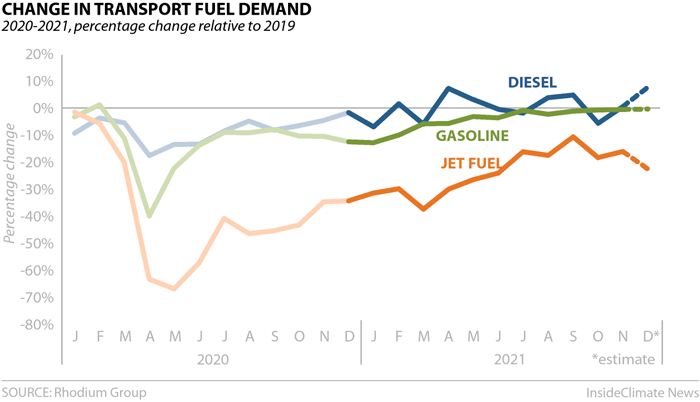

The figure below shows the growth in diesel demand in 2021. I expect this trend will continue. I wonder whether that will put pressure on states to push for alternatives, such as electrification and low carbon fuels. Some states will want to go the electrification route, but that’s not been so easy so far. Case in point: a recent Calstart report has found that 1,215 medium-duty and heavy-duty vehicles have been deployed throughout the U.S. but 60% of them are non-operational. Newer, more advanced models are coming and there will be more model selection in the coming years, to be sure. But I think it does highlight that there will be a transition, and maybe a long one, to electrified trucking. That’s going to leave low carbon fuels to serve both the legacy fleet and newer trucks. Where does that leave the policy landscape?

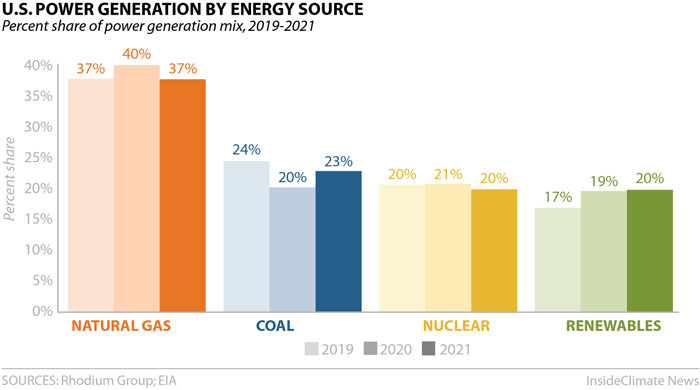

In comparison, between 2005 and 2019, U.S. emissions fell nearly 1 percent annually, on average, according to the Environmental Protection Agency. The uptick occurred largely due to a 17 percent jump in coal-fired power generation, the first annual increase in coal generation since 2014, and a rapid resurgence of road transportation. Coal’s comeback was driven largely by a hike in natural gas prices, which made coal power more economically attractive, according to the report.

Renewable energy generation growth slowed to half of its 2020 rate but accounted for 20 percent of U.S. electricity generation for the first time.

Without the Democrats’ Build Back Better bill the U.S. is only on course for emissions reductions of roughly 30 percent by 2030, according to the report, not enough to align with Paris Agreement climate targets.

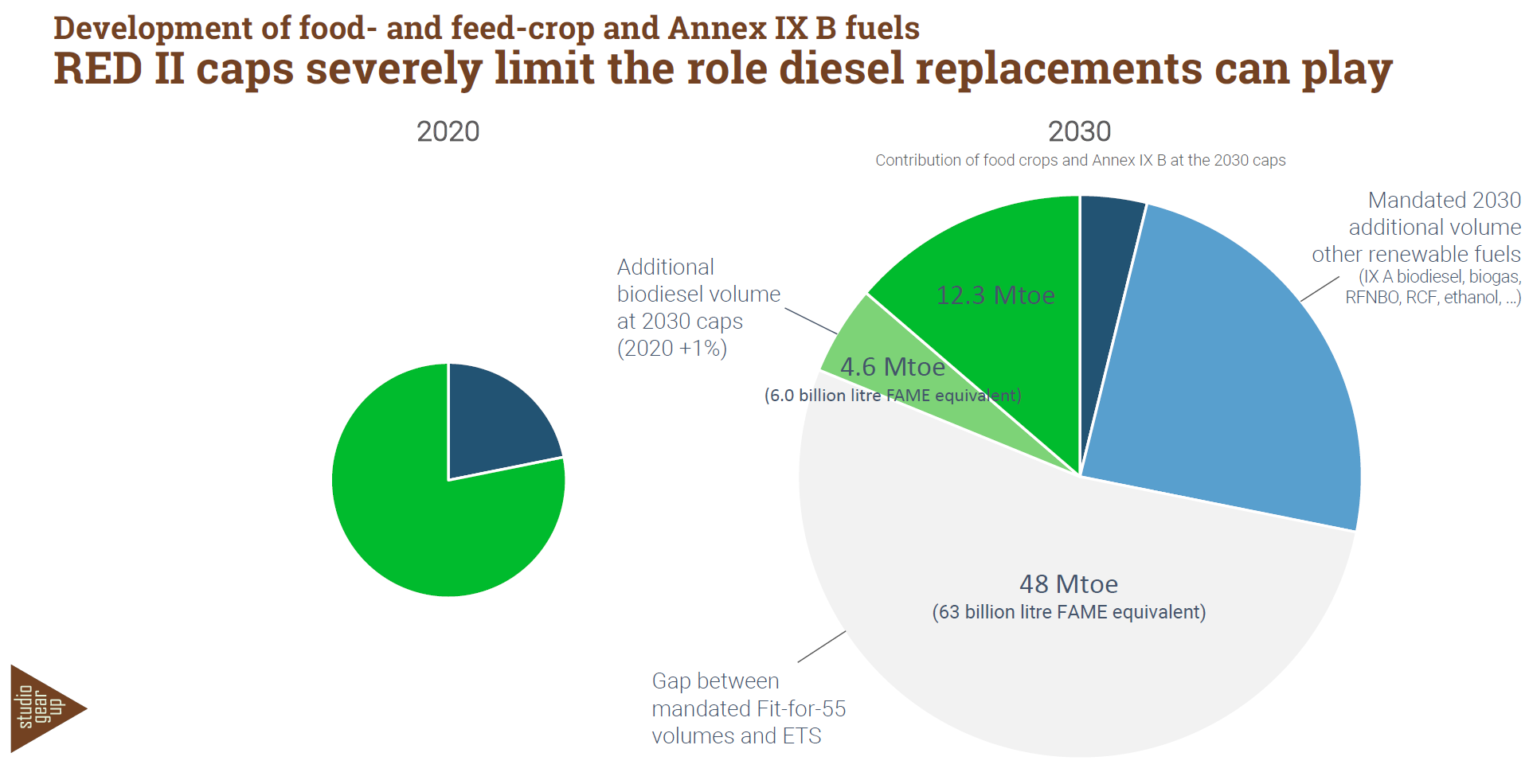

2. EURACTIV: Green Fuels Shortage Looming Due to EU Restrictions, Industry Warns – Demand for green liquid fuels in Europe is set to double by 2030, an industry-commissioned study by the consultancy Studio Gear Up has found, as the EU seeks to decarbonize maritime, aviation, and heavy-duty road transport by replacing fossil fuels. Meeting the targets set out in the revised Renewable Energy Directive (RED), FuelEU Maritime, and the ReFuelEU Aviation mandates will require around 42 million tons of oil equivalent, according to the study. EURACTIV notes that the expansion of the EU’s carbon market to private cars is additionally expected to boost demand for low-carbon fuels ahead of the mass adoption of zero-emission vehicles across the EU. However, and as a graphic from the study shows, current RED restrictions on feedstocks make meeting future targets very difficult.

Source: Studio Gear Up, November 2021

It will be interesting to see how EU policymakers receive this in light of another study recently completed for the European Commission by a consortium of consulting groups which evaluated biofuels feedstocks that could potentially be added to the approved feedstock list, Annex 9 of the RED.

3. The Wall Street Journal: Suspend the Gas Tax, They Cried – Democratic Senators Mark Kelly (Arizona) and Maggie Hassan (New Hampshire) last week introduced legislation in the U.S. Congress to waive the 18.4 cent per gallon federal gas tax through 2022. Notably, both are up for election in November, along with co-sponsors Raphael Warnock (Georgia), Catherine Cortez Masto (Nevada), Debbie Stabenow (Michigan) and Jacky Rosen (also Nevada), so the timing for such legislation is, well, kind of convenient, don’t you think?

I would also point out the irony: These very same Democrats have supported super green measures such as the Green New Deal and the Build Back Better proposed legislation. I’ve said for years and still believe that if we’re really serious about climate, the first thing that should happen is to increase federal gasoline tax – which has not happened until 1993. That’s right, it’s been almost 30 years. And incidentally, lest you get the wrong idea, I support climate initiatives very much. But real ones that deliver results. To me, those are well-crafted incentives, targeted taxation, efficiency measures and well-crafted R&D spending.

However, the gas tax is a political football no one in either political party in the U.S. wants to pick up and run with to this day. What does that say about the tough choices that lie ahead to achieve net zero? As the op-ed points out, “Hello? Isn’t the point of Democratic climate plans to raise the price of fossil fuels so we use less? Or at least it is until rising gasoline prices begin to have political consequences.” And that’s what policymakers have to do: face the consequences and get their constituents to do the same in the name of climate. Not only is this kind of backsliding happening in the U.S., it’s happening in other parts of the world as well, particularly in Europe. Bottom line: I remain skeptical of any climate plan put forward in the U.S., especially for transport.

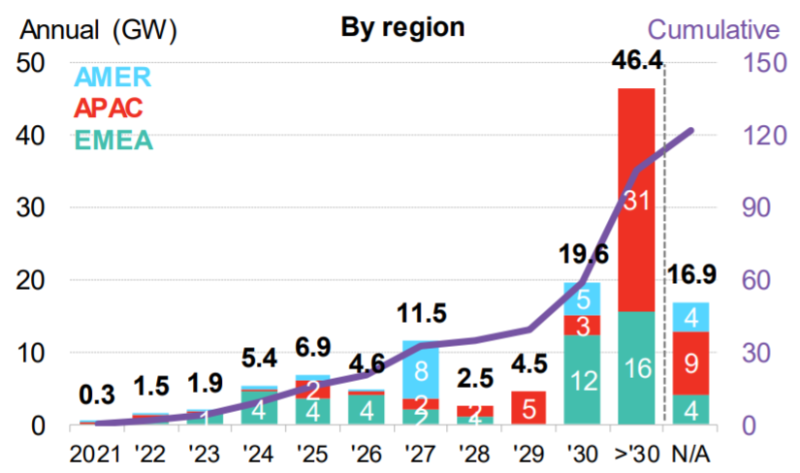

4. Green Car Congress: BNEF: Electrolyzer Sales More Than Doubled In 2021, Set to Grow 4-5x This Year – Earlier this month Bloomberg New Energy Finance (BNEF) published its now annual hydrogen market outlook finding that annual government funding for hydrogen has reached $16 billion per year globally, up 40% from July 2021. Electrolyzer sales have more than doubled to 458MW in 2021 and are set to grow 4-5x this year. Almost two-thirds of these sales will happen in China. The figure below from BNEF shows the announced pipeline of projects by proposed by developers. I’m tracking these developments as well for Transport Energy Outlook members and they can access the green hydrogen projects database I’ve created for them at this link. Much of this planned hydrogen would be destined for hard-to-abate industrial sectors, not transportation.

Source: BNEF, February 2022

5. El País: How Nations Sitting on Lithium Reserves Are Handling the New ‘White Gold” Rush – The economic outlook for Latin America is not great, but lithium presents a pathway to help turn things around. The Bolivia-Argentina-Chile ” lithium triangle” accounts for 63% of the planet’s reserves. Peru and Mexico are in possession of a further three million tons or thereabouts. This article notes that, “Lithium is, for big investors, the brightest star on the Latin American map.” As a result, governments are beginning to move to nationalize lithium mining such as:

Argentina is, to some extent, the exception. There, exploration rights are in the hands of the provinces and President Alberto Fernández’s government has sought to promote the country’s reserves worldwide. In 2020, Fernández set out to increase annual lithium carbonate production by 700% to 230,000 tons by the end of this year. This will require an investment of more than $1 billion by the private sector. During Fernández’s visit to China at the beginning of February, government officials revealed that Argentina is negotiating with the Chinese to establish new investments, including plans to set up a battery factory, the article notes.

Tammy Klein is a consultant and strategic advisor providing market and policy intelligence and analysis on transport energy to the auto and oil industries, alternative fuels industries, governments and NGOs. She writes and advises on petroleum fuels, biofuels and other alternative fuels, and fuels policy, market and technology issues.