Hello friends! Here’s my monthly take on five most interesting developments in transport energy trends. What I try to do each month is select stories, studies and other interesting items that you may not have seen elsewhere but that really represents an important issue or trend that I think you would want to know about. Or I try to poke behind the hype to provide a deeper understanding of what’s happening. Items I selected this month include:

1. The New York Times: A Power Struggle Over Cobalt Rattles the Clean Energy Revolution – This article focuses on an investigation by the Times of the cobalt industry in the Democratic Republic of Congo. The Times notes that more than 100 interviews and thousands of pages of documents show that the race for cobalt has set off a power struggle in Congo and in particular, a rivalry between China and the United States which could have far-reaching implications for the environment.

According to the Times, China is so far winning that contest, with both the Obama and Trump administrations “having stood idly by” as a company backed by the Chinese government bought two of the country’s largest cobalt deposits over the past five years. Five biggest Chinese mining companies in Congo had lines of credit from state-backed banks that totaled $124 billion, and the country’s goal is to control the global supply chain.

The Biden Administration is now trying to catch up and has warned that China might use its growing dominance to disrupt the America (and probably European as well!) push to EVs. In response, the United States is pressing for access to cobalt supplies from allies, including Australia and Canada. The race is leading to an increase in raw materials prices leading to an increase in EV battery prices for the first time.

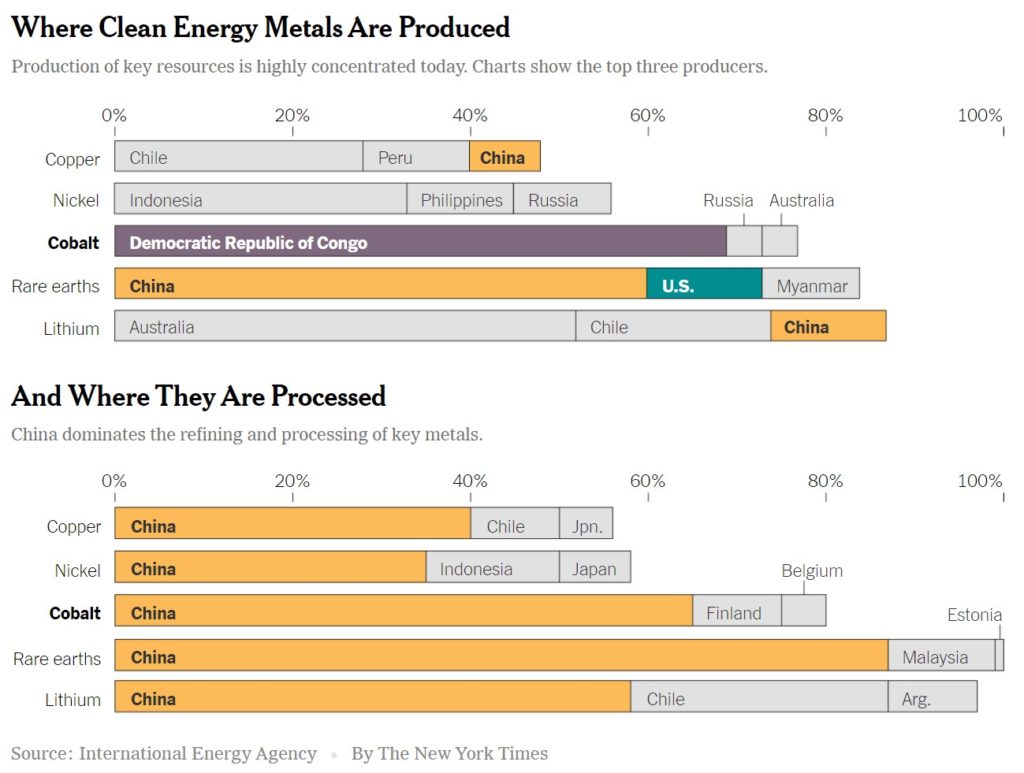

Companies like Ford are developing lithium iron phosphate substitutes or turning to recycling. Chinese companies in the Congo are increasing their mining and refining of cobalt. But a shortage is expected by 2030, according to IEA. Some firms have put that shortage occurring in 2025. The figure below summarizes where clean energy metals are currently produced.

The article goes into great detail about the numerous issues with the Chinese mining cobalt in the Congo: broken promises to construct new infrastructure in the country, horrible worker conditions, potential cheating on royalties due to the Congo, loss of local jobs to the Chinese, trespassers at mine sites who take away already mined cobalt, and more. The Times documents plenty of shadowy organizations and dealings as between the U.S. and the Congo. The real kicker for me: the rickety, fumy minibuses some miners ride in to work, with probably not the best fuel quality, so that they can mine cobalt for the clean energy/EV revolution in the West and China. Ironic. Weirdly colonialistic in these so-called enlightened times. And not very sustainable.

2. Hydrogen Fuel News: Will Green Hydrogen Demand Be too Much for Electrolyzers in Only a Few Years? – According to the financial firm Jeffries Group, by 2030, global green hydrogen demand will already have overwhelmed the number of electrolyzers capable of producing it. By the end of this decade, the worldwide supply of electrolyzers will have reached 47GW, but “could sit somewhere in the 30-40GW range”.

Comparatively, there are 54GW of announced projects and 94GW of projects that are “pledged” according to the firm’s report on the issue. “The conclusion is that there is unlikely to be sufficient supply even for the proposed projects out to 2030 even in the lowest demand scenario.” The firm sees primary se cases for industrial applications already using hydrogen such as refining, methanol, ammonia and steel making.

“We see the nearest use cases as those industrial applications that already use hydrogen: oil refining, methanol, ammonia, steel making,” said the report. “Beyond that, we believe that there is scope for heavy vehicles, with [battery] EVs winning the passenger vehicle race, and beyond that, stationary power… mobility and power look to be medium to longer term aspirations.”

Jefferies predicts that by 2030, the cost of blue H2 will have reached between $1.25 to $2.00 per kilogram; for green hydrogen, figures are expected to fall from the current $3.00 to $6.55 per kilogram to $1.50 per kilogram by the end of the decade. The Jeffries report says CCS does not work at scale and blue H2 will not be able to fill the gap for green hydrogen because:

Meantime, a Washington Post article notes that a new study published in the journal Applied Energy found making hydrogen from fossil fuels produces “substantial” GHG emissions that are the driver of global warming, even with CCS. “Our work highlights that large investment in fossil-fuel-based hydrogen with CCS could be risky, locking in a new fossil fuel industry with significant emissions, and one that is likely to be out-competed by renewable technologies in the future,” said Fiona Beck, from the Australian National University, who co-authored the peer-reviewed paper.

3. Biofuels Digest: The Grand Switcheroo: Is the Biden Administration Aiming Corn Ethanol at SAF, Putting Spirit in the Sky? – Jim Lane makes the case that the Biden Administration may be aiming to transition corn ethanol from the light-duty fleet, which it wants to electrify, to the sky for sustainable aviation fuel (SAF). He wonders:

“So, why not simply take that potential farm sector debacle and hand the corn growers a vibrant new market in aviation. In aviation, electrification of heavy-duty jets is almost as far away as Warp Drive and Mind-Melding. And, the blend limits are better — 50 percent vs 10 percent today, and drop-in fuels at 100 percent blends are becoming a reality.

Do the economics work? Is that the strategy. We’ll have to wait for more. But I do wonder if I was the only observer saw a Grand Switcheroo on the immediate horizon?”

No, he is not. I have wondered about this and so have others in the ethanol industry and beyond. I know for a fact that DOE has considered this very same scenario and that there have been discussions around this topic. I find it strange though that ethanol is an “untouchable” when it comes to the light-duty fleet and there are plenty of critics over whether its use contributes to real-world GHG emission reduction, though plenty of analyses from different organizations including even Argonne (and my own firm) have shown that that answer is yes, and significantly so, depending on certain conditions (e.g., the use of CCS, renewable energy use, soil organic carbon accounting, etc.). However, when talking about ethanol for aviation, those critics evaporate into the ether. Very strange.

Jim also recounts the unease around the potential passage of the SAF tax credit as part of the House Build Back Better legislation. That’s understandable given the internecine tug of war that had been going on within the Democratic party this year which greatly slowed down progress on passage of the legislation and with it, the tax credit.

However, with the loss of the state of Virginia governorship (a heretofore safe Democratic seat) to a Republican and the public’s growing irritation over the Administration’s handling of the pandemic, inflation, Afghanistan and lack of movement on other policy priorities – including the infrastructure legislation – House Democrats will get a move on and get that legislation passed. I feel more confident than those cited in the column that that the BBB legislation and with it, the tax credit, will be passed by the end of this year.

4. WIRED: Used EVs Are in Hotter Demand Than Ever – Once upon a time, used EVs were sold overseas while new EVs were sold in the U.S. That’s all changing now. WIRED reports that half a million may be sold in the U.S. by the end of the year more than double sales of three years ago. Though they might have been a hard sell a few years ago, WIRED notes there are more options, more familiarity, fewer fears about batteries and range, and more public chargers, with even more on the way. Gasoline prices are up which is not hurting the business case for consumers. And there are simply fewer cars to buy at all with the ongoing chip shortage that has dampened manufacturing.

The article notes Build Back Better legislative provisions that would provide a tax credit for used cars, as well as local programs aimed at getting those with moderate or lower incomes in a used EV, with mixed results. Oregon’s clean vehicle rebate program, begun in 2018 for low- and moderate-income households, has seen just 516 buyers opt for used EVs, or about 5 percent of the vehicles purchased through the program. The rest bought new models.

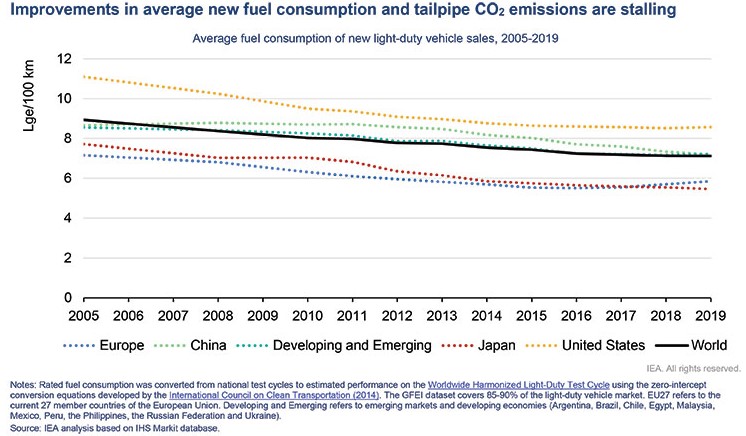

5. Global Fuel Economy Initiative (GFEI): Vehicle Efficiency Improvements Vastly Insufficient to Achieve Paris Goals Says New GFEI Report in Urgent Call for Policy Action – According to a new report released by GFEI, urgent action is needed by policymakers to reduce CO2 emissions from vehicles globally. Over the past decade, the rate of fuel economy improvement in major markets has stalled and the report advocates that “there must now be a rapid shift to electric vehicles” to achieve the levels of CO2 reductions needed to achieve the Paris Agreement targets. This is stalling is shown in the figure below.

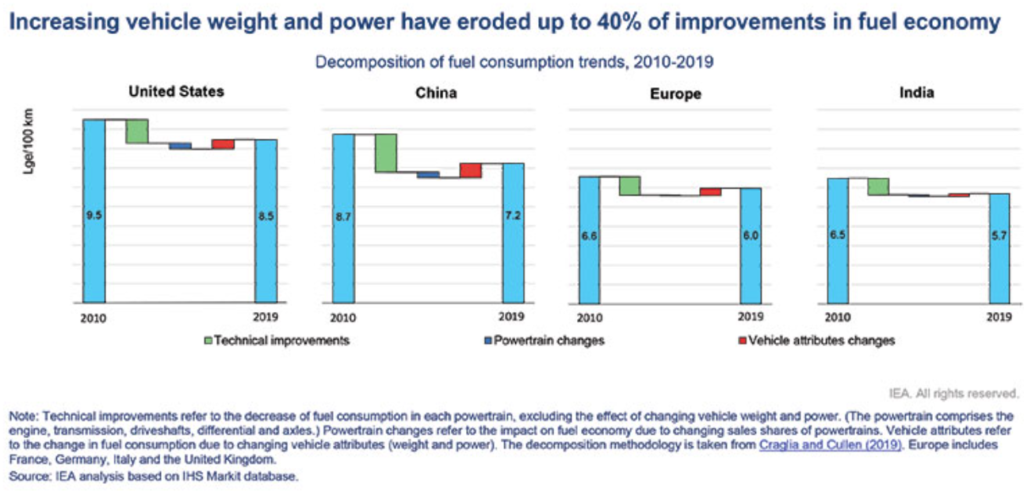

Almost 90% of global light-duty vehicle sales, between 2017 and 2019, average rated fuel consumption of new light-duty vehicles fell by only 0.9%, far less than the 1.8% annual average reduction between 2010 and 2015. Increasing vehicle weight and power were a major impediment to further improvement. SUVs made up 44% of all light duty sales in 2019 and eroded up to 40% of improvements in fuel economy. This is shown in the figure below.

Other conclusions of the report include:

Tammy Klein is a consultant and strategic advisor providing market and policy intelligence and analysis on transport energy to the auto and oil industries, alternative fuels industries, governments and NGOs. She writes and advises on petroleum fuels, biofuels and other alternative fuels, and fuels policy, market and technology issues.