Hello friends! Here’s my monthly take on five most interesting developments in fuels and vehicles trends. What I try to do each month is select stories, studies and other interesting items that you may not have seen elsewhere but that really represents an important issue or trend that I think you would want to know about. Or I try to poke behind the hype to provide a deeper understanding of what’s happening. Items I selected this month include:

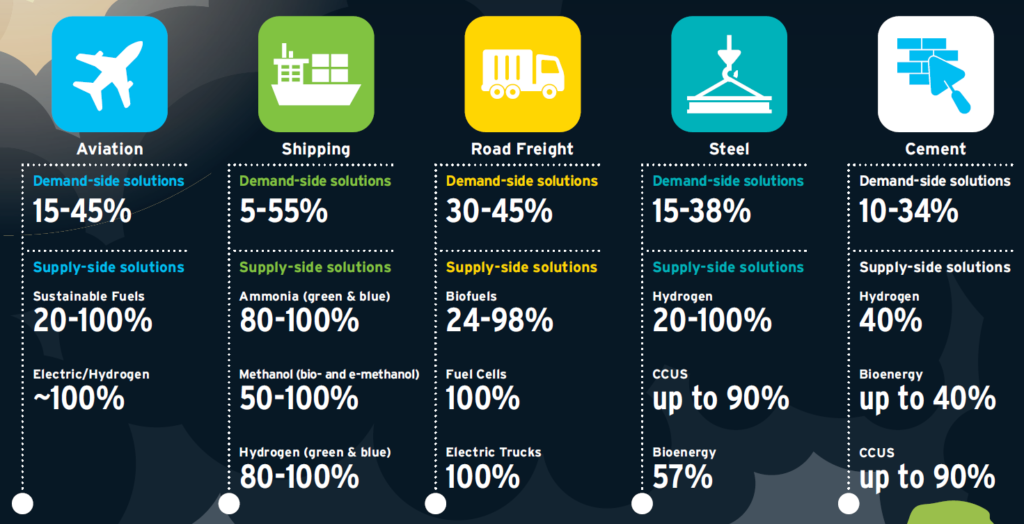

1. Citi GPS: Hard to Abate Sectors – In this report, Citi’s Sustainable Finance team took a detailed look at two hard-to-abate sectors — transport (road freight, aviation and shipping) and industry (cement and steel) — which need to be focused on to successfully meet net-zero emission commitments. Collectively, these sectors account for 25% of today’s global carbon emissions but have the potential to rise by 50% through 2050 given growth expectations.

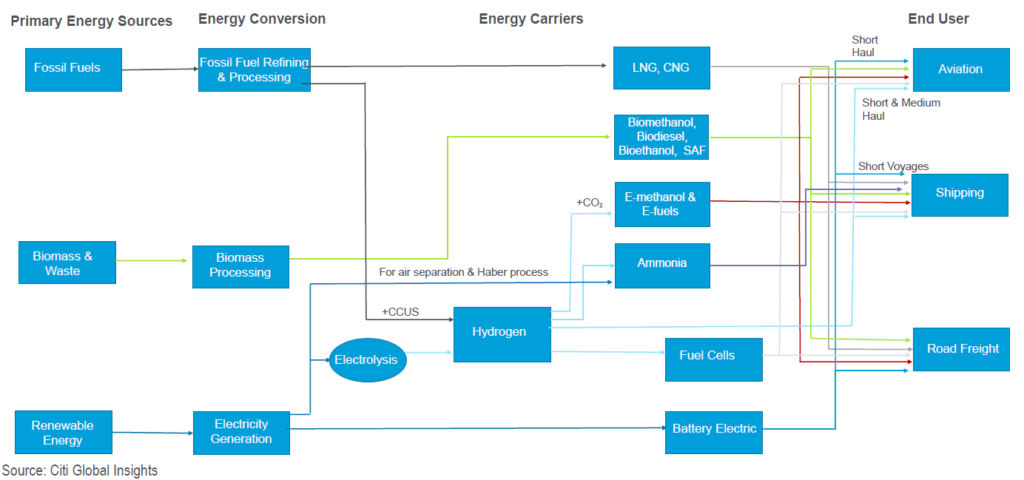

Citi notes that although demand-side solutions can help, they’re not sufficient to drive emissions levels down towards zero. Instead, supply-side solutions need to be incorporated. The team identified three such solutions — hydrogen, bioenergy, and carbon capture, utilization & storage (CCUS) — they believe can be the keys to ‘cracking the carbon nut’ in hard-to-abate sectors. Citi says there is a cost premium associated with each of these solutions, but as technology advances and supply is scaled up, they expect costs to decrease and demand to increase.

Demand-Side Solutions in Hard-to-Abate Sectors

Source: Citi

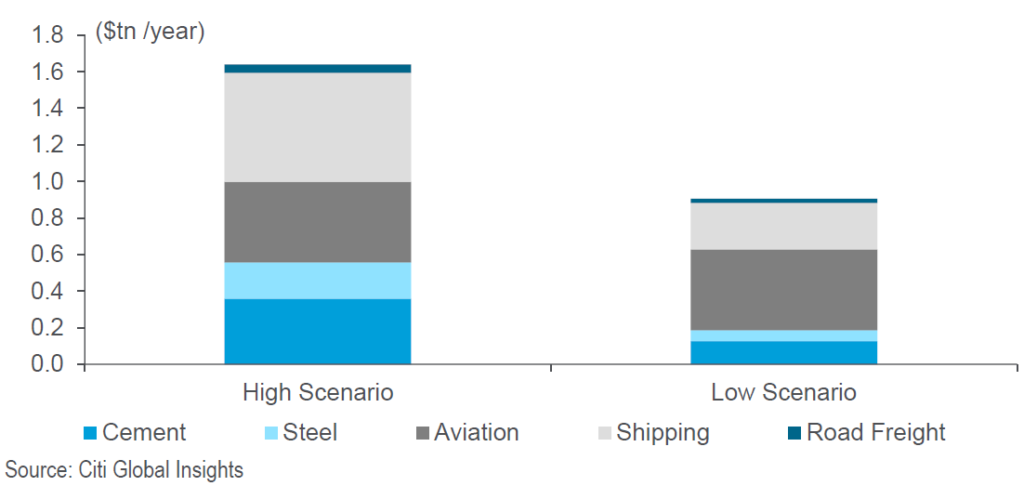

To decarbonize these hard-to-abate sectors, Citi’s scenario analysis predicts it will cost between $1.6 trillion and $0.9 trillion, equivalent to 1.9% of global GDP in 2019, and will require cooperation between public and private institutions and a commitment to deploy capital and invest in technologies that enable the transition to a net zero economy.

To put Citi’s results into some perspective, $1.6 trillion is approximately 1.9% of global GDP in 2019. Governments spent approximately $468 billion in 2019 on support for the production and consumption of fossil fuels, which is approximately half of what is needed for our low-cost scenario. According to Citi, this is doable. Citi also says, “It is important to note that cost premiums associated with decarbonizing hard-to-abate sectors might be affordable in rich nations, but they might have a material impact on developing nations, especially in relation to the increase in prices on steel and cement.” The figure below summarizes the estimated decarbonization costs by sector.

Estimated Cost to Decarbonize Hard-to-Abate Sectors (High & Low Scenario)

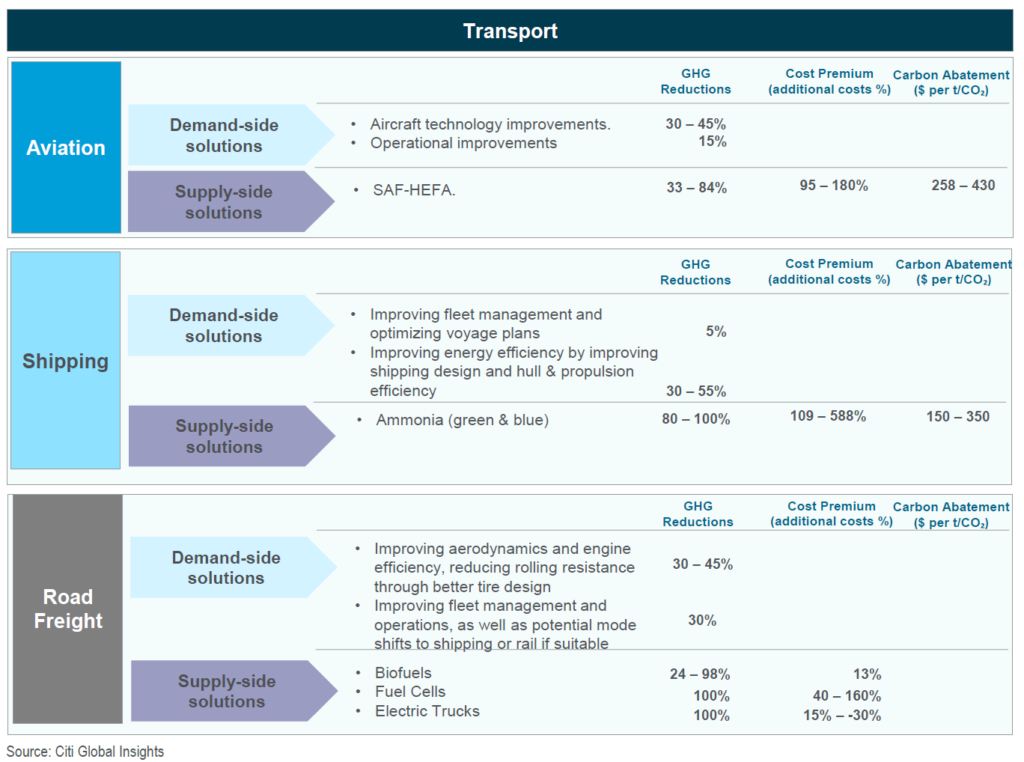

The figure below summarizes the results of its analyses on transport. The results show the technologies and available fuels that Citi believes are most likely to be used to decarbonize these sectors. Citi notes, “Other solutions exist, including the use of biofuels for the shipping industry, plus hydrogen and battery-operated flights for aviation.”

Decarbonization Solutions for Transport

With respect to these solutions, Citi notes the following:

Alternative Fuels to Reduce GHG in Transport

2. Transport & Environment: Carbon Offsets Used by Airlines Not Credible, Investigation Shows – A recent investigation by The Guardian and Unearthed, Greenpeace’s investigative division, found that carbon offset schemes used by some airlines, such as British Airways and EasyJet, are deeply flawed. One of the main offset accreditors, Verra, whose “avoided” deforestation scheme was criticized in the investigation for lacking credibility, also supplies credits for the UN Corsia scheme, the global agreement designed to tackle airline emissions.

In November 2020, T&E notes, the International Civil Aviation Organization (ICAO) broadened the range of natural climate solutions, such as forest protection schemes, accepted under Corsia. It was the first international compliance carbon market to accept such credits. The finding follows an unpublished EU study, obtained by T&E in March, which heavily criticized Corsia, suggesting that it could actually undermine Europe’s climate effort. It found that the Corsia deal is “unlikely to materially alter” the climate impact of air travel with “none” of the approved offsetting programs meeting all the required criteria. Could we see an even greater reliance by the airlines on sustainable aviation fuel (SAF) because of this offset credibility issue? I think so.

3. Biofuels Digest: New Miscanthus Finance and End-User Offtake Agreements Assist UK Decarbonization –Biofuels Digest reported that, in an industry first, farmers in the UK considering planting the carbon negative crop Miscanthus can now benefit from a finance package to cover virtually all upfront costs for crop establishment, as well as new direct, long-term offtake agreements with end-users, with 10–15-year index-linked annual returns.

Oxbury Bank is working in partnership with Miscanthus specialist, Terravesta, to deliver the new finance package, which is supporting farmers to plant and establish the crop. “One of the main barriers to entry for Miscanthus growing is the upfront cost of planting. Our finance package with Terravesta ensures a quick release of funds to help farmers to grow a sustainable business. The loan structure allows farmers to pay interest only for up to two years while the crop is establishing and then pay back the capital over an extended period of time when the crop is producing an economic return,” says Nick Evans, managing director of Oxbury Bank. Under the new contract, Terravesta will supply its Performance Hybrids, planting equipment and agronomy throughout the crop’s life, ensuring successful crop establishment by committing to a minimum number of plants emerging under its new planting promise.

One of the major discussions of the day concerns renewable diesel (HVO) feedstock: Will there be enough? Where will it come from? Can the industry move away from feedstocks such as soybean oil or used cooking oil? I think they can – over time and with the right mix of corporate support and government incentives to farmers, such as the foregoing financing arrangement. If governments want decarbonization and they want economies of scale, they will target agriculture with programs and incentives that will help farmers get there. That could mean growing non-traditional feedstocks for biofuels production, including for HVO.

4. Politico: Brussels Drafts Death Sentence for The Internal Combustion Engine Car – Politico learned from three officials that the European Commission is debating setting a zero-emissions target for vehicles sold beyond 2035 — a huge shift from the current trajectory of industry standards that would mark a revolution for Europe’s automakers. The new rules would come under a revamp of the bloc’s car emissions reduction standards, part of the EU’s Green Deal plan to hit net-zero CO2 emissions by mid-century.

The Commission is considering increasing the bloc’s 2030 target to mandate a 60% reduction in car emissions, compared to the current goal of a 37.5% cut. By 2035, that would rise to 100 percent, the three officials said. If the proposal makes it into the final text — due to be published on July 14 — it would then be considered by EU countries and the European Parliament. One auto manager cited in the study highlighted that the plan would be difficult to execute without an increase in EV infrastructure, which is lacking in Europe to support such a scale up. Transport Energy Outlook members can read more about the challenge in Europe, U.S. and China in June’s monthly report.

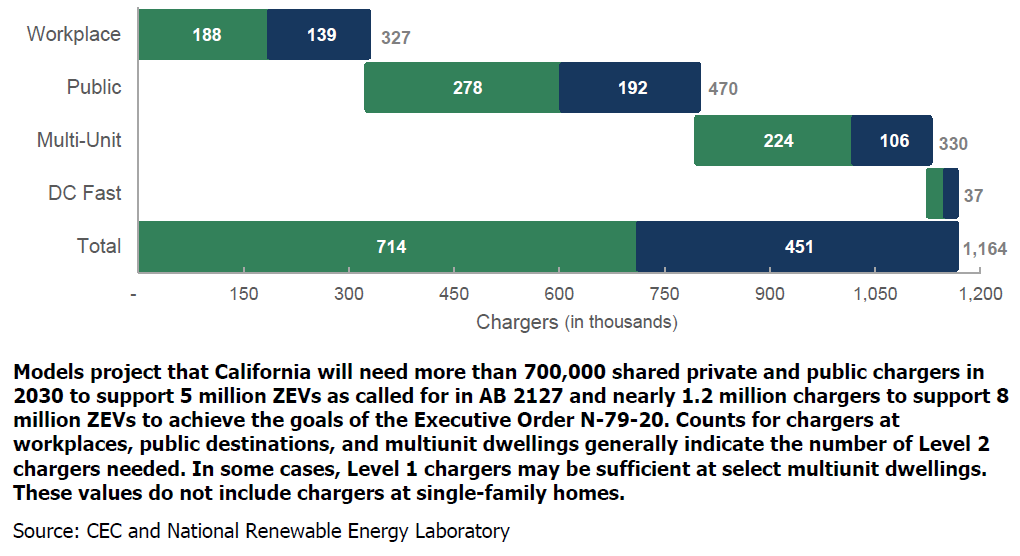

5. California Energy Commission (CEC): Report Shows California Needs 1.2 Million Electric Vehicle Chargers by 2030 – Analysis from the California Air Resources Board (CARB) estimates that 8 million light-duty ZEVs and 180,000 medium- and heavy-duty ZEVs will be needed in 2030 to meet the new goal. For passenger vehicles, CEC in this report projects that over 700,000 chargers are needed to support 5 million ZEVs and nearly 1.2 million public and shared private chargers are needed to support almost 8 million ZEVs in 2030. For medium- and heavy-duty charging in 2030, modeling analysis suggests that 157,000 chargers are needed to support 180,000 ZEVs. This is summarized in the figure below.

Projected 2030 Charger Counts to Support 5 Million and 8 Million Light-Duty Zero-Emission Vehicles

As of Jan. 4, 2021, CEC notes there are more than 70,000 public and shared private chargers available across the state. This report finds that an additional 123,000 chargers are planned (through state grants, approved utility investments, and settlement agreements), bringing the total to 193,000 chargers. To meet the 2025 goal of 250,000 public and shared chargers, the state will need about 57,000 more than are already installed or planned.

This report identified several actions to support the widespread deployment of charging infrastructure:

Tammy Klein is a consultant and strategic advisor providing market and policy intelligence and analysis on transportation fuels to the auto and oil industries, governments, and NGOs. She writes and advises on petroleum fuels, biofuels, alternative fuels, automotive fuels, and fuels policy.