Hello friends! Here’s my monthly take on five most interesting developments in transport energy trends. What I try to do each month is select stories, studies and other interesting items that you may not have seen elsewhere but that really represents an important issue or trend that I think you would want to know about. Or I try to poke behind the hype to provide a deeper understanding of what’s happening. Items I selected this month include:

International Energy Agency (IEA): World Energy Outlook (WEO) 2022 – IEA opens this year’s WEO by noting that the global energy crisis triggered by Russia’s invasion of Ukraine “is causing profound and long-lasting changes that have the potential to hasten the transition to a more sustainable and secure energy system.” Governments including the U.S., EU, Japan, China and Korea are responding with policies to diversify oil and gas supplies, accelerate structural changes in markets and combat climate change. But policies such as Fit for 55 and the Inflation Reduction Act are not going to be enough to reach net zero. They are merely downpayments.

In the WEO’s Stated Policies Scenario (STEPS), which is based on the latest policy settings worldwide, these new measures help propel global clean energy investment to more than US$2 trillion a year by 2030, a rise of more than 50% from today. It also results in global demand for every fossil fuel exhibiting a peak or plateau – for the first time ever. Still, IEA notes even stronger policies will be essential to drive the huge increase in energy investment that is needed to reduce the risks of future price spikes and volatility.

There are two other key scenarios explored in the WEO, in addition to STEPS:

Some key highlights of interest are presented in brief below.

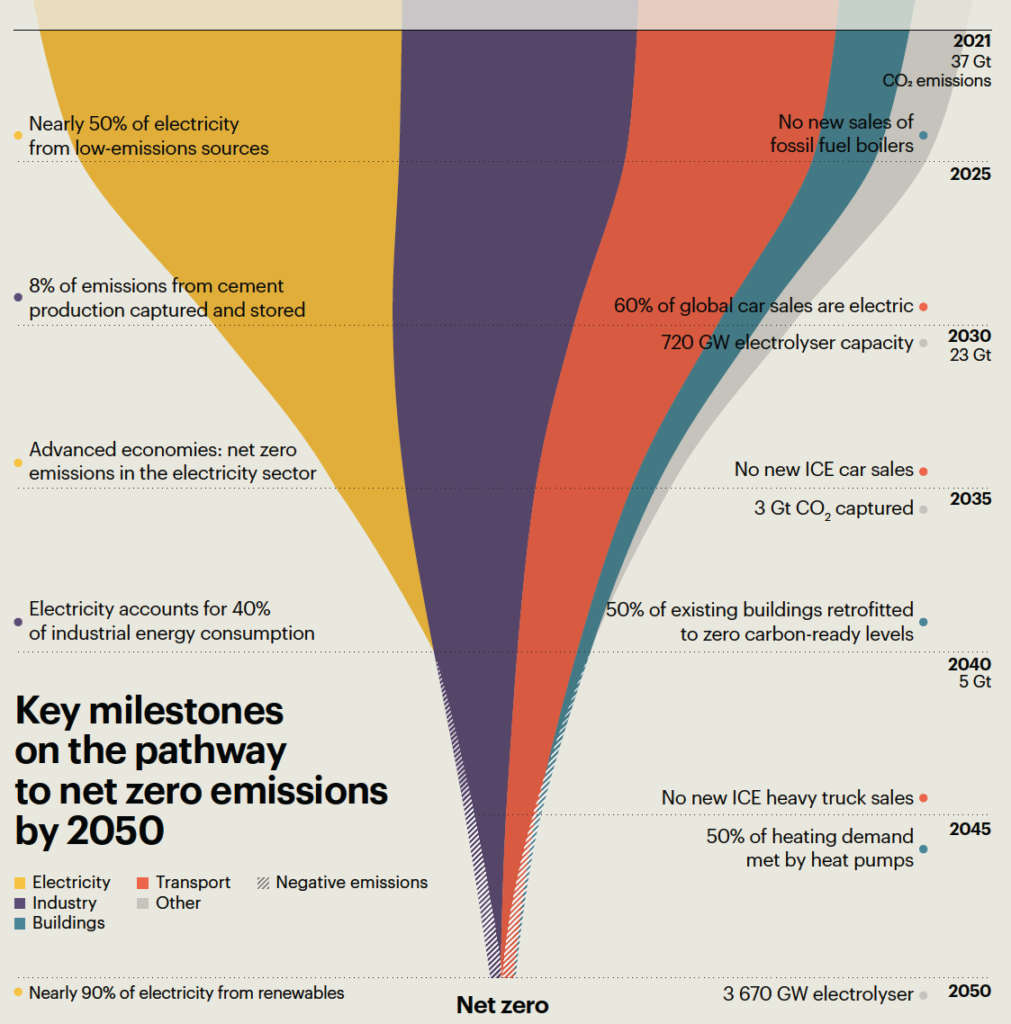

Mountainous Milestones Need to be Reached for Net Zero

What are some milestones that need to be achieved to, in turn, achieve net zero? As it concerns transport, it will be high degrees of electrification in both the light- and heavy-duty fleets, shown in the graphic below. But it will also involve substantially increasing low-emission electricity, reaching net zero in the electricity sector for developed economies and massively scaling up electrolyzers. Much needs to happen between 2030-2035, shown in the figure below. The milestones are more like mountains that need to be moved – and quickly.

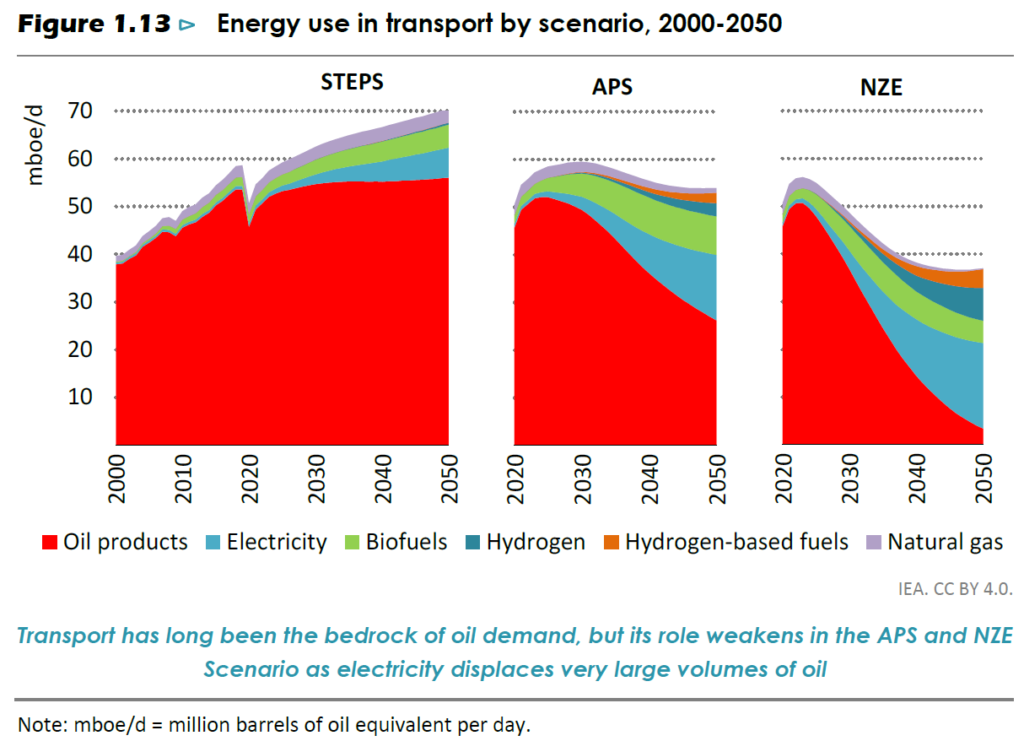

Peaking Oil Demand: Demonstrated in Transport

Oil demand peaks in each scenario in the Outlook, shown in the figure below. In the STEPS, demand reaches a high point in the mid‐2030s at 103 mb/d and then declines very gently to 2050. Global gasoline demand peaks in the near term and falls as EVs deploy. Demand in advanced economies declines by 3 mb/d to 2030, mainly because of reductions in road transport, but this is more than offset by increases in emerging market and developing economies where demand rises by 8 mb/d this decade, IEA notes.

Globally, the main sectors seeing an increase in the use of oil are aviation and shipping, petrochemicals (where oil is used as feedstock), and heavy trucks, where oil is used as a fuel and not displaced by the rise of EVs in the same way as in other road transport modes. These sectors see a rise in demand of around 16 mb/d between 2021 and 2050, but from the mid‐2030s growth in these sectors is more than offset by declining oil use elsewhere, especially in passenger cars, buildings and power generation.

Milestones for Decarbonizing Transport

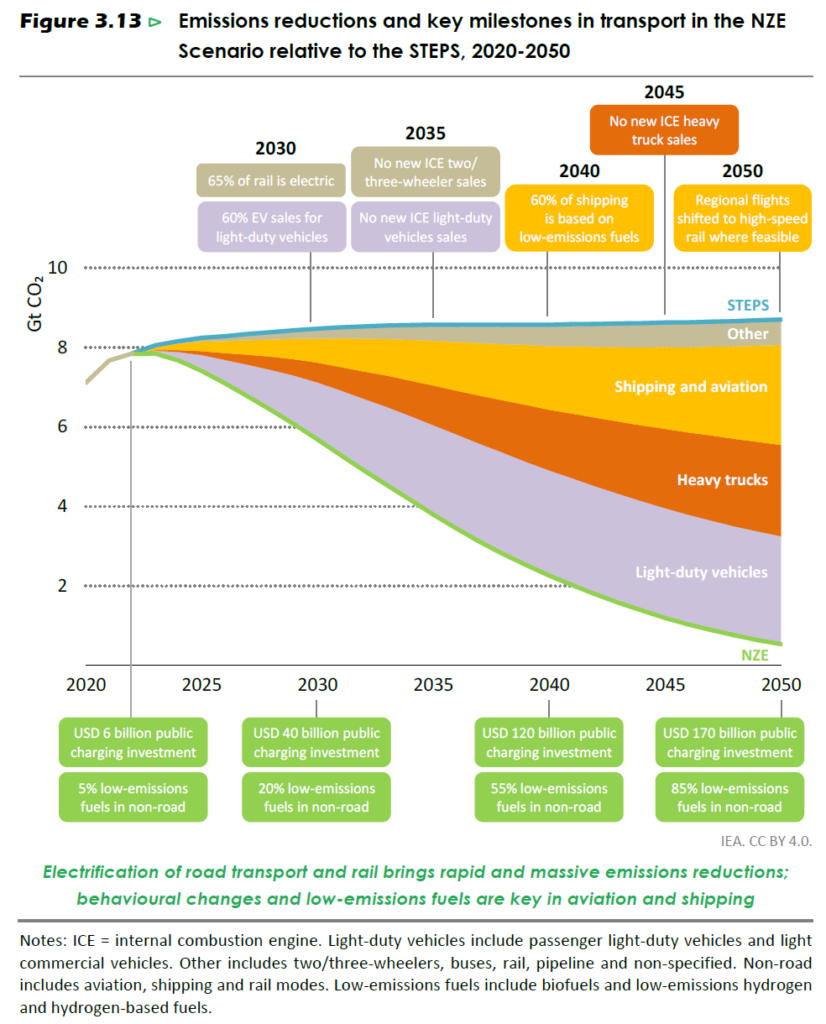

According to the WEO, both passenger and freight activity are set to more than double by 2050 in the NZE Scenario, driven by higher mobility needs in emerging markets and developing economies as their economies and populations grow and living standards increase. Energy demand growth is tempered in the NZE Scenario by improvements in technical and operational efficiency across all modes – road, aviation, shipping and rail – as well as by the deployment of highly efficient vehicles, i.e., EVs, and policies to promote modal and behavioral shifts.

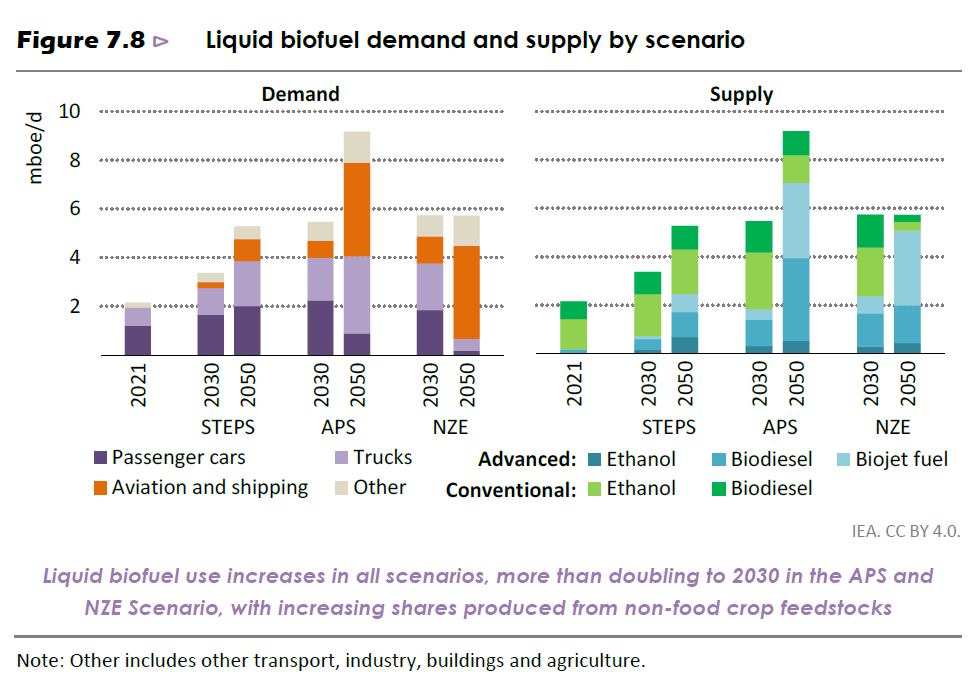

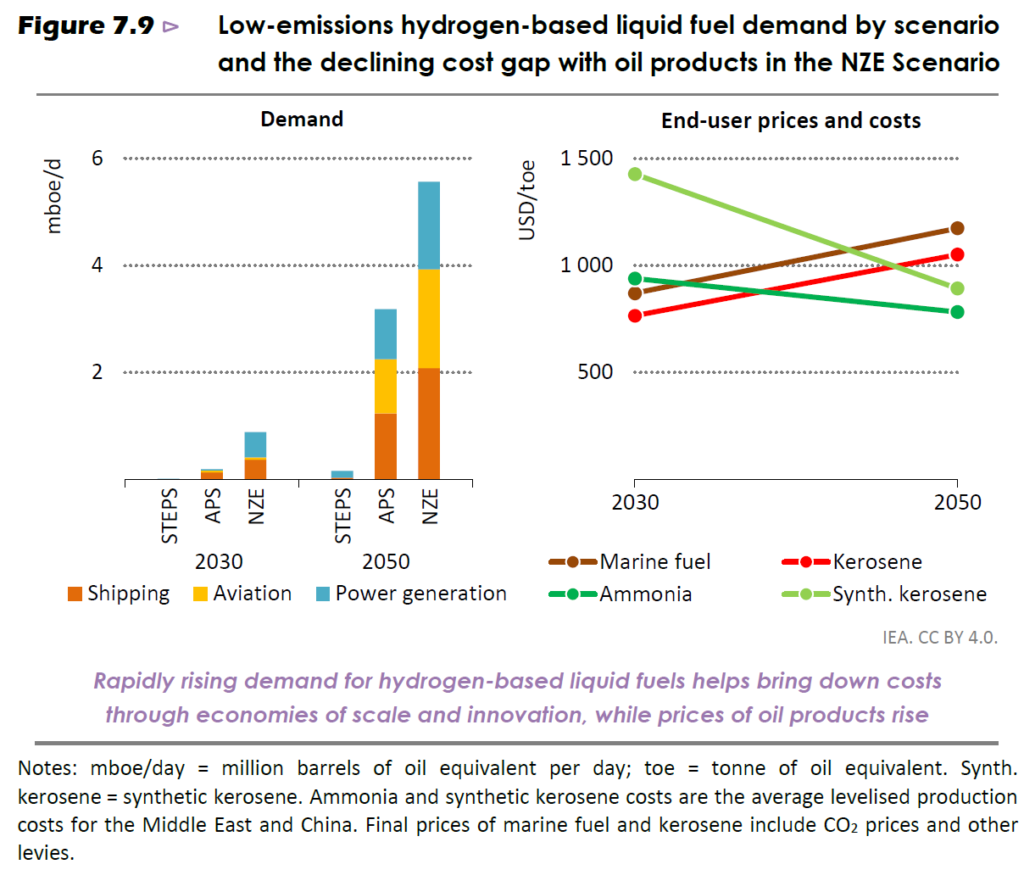

IEA notes decarbonizing the transport sector in the NZE Scenario depends primarily on two changes, shown in the figure below. First is a switch to electricity, especially for the use of EVs and hydrogen fuel cell electric vehicles in road transport. Second is a move to both blending and direct use of low‐emissions fuels such as biofuels, hydrogen and hydrogen‐based fuels, especially in aviation and shipping. IEA notes that biofuels are blended into other fuels in growing quantities in road transport through to 2030 but are increasingly used instead in aviation and shipping beyond 2030 as electrification becomes the most cost‐effective option for decarbonizing the road sector. Direct use of hydrogen, and of low‐emissions synthetic fuels such as synthetic kerosene and ammonia, increases rapidly to meet demand in long‐distance modes of transport, mainly aviation and shipping.

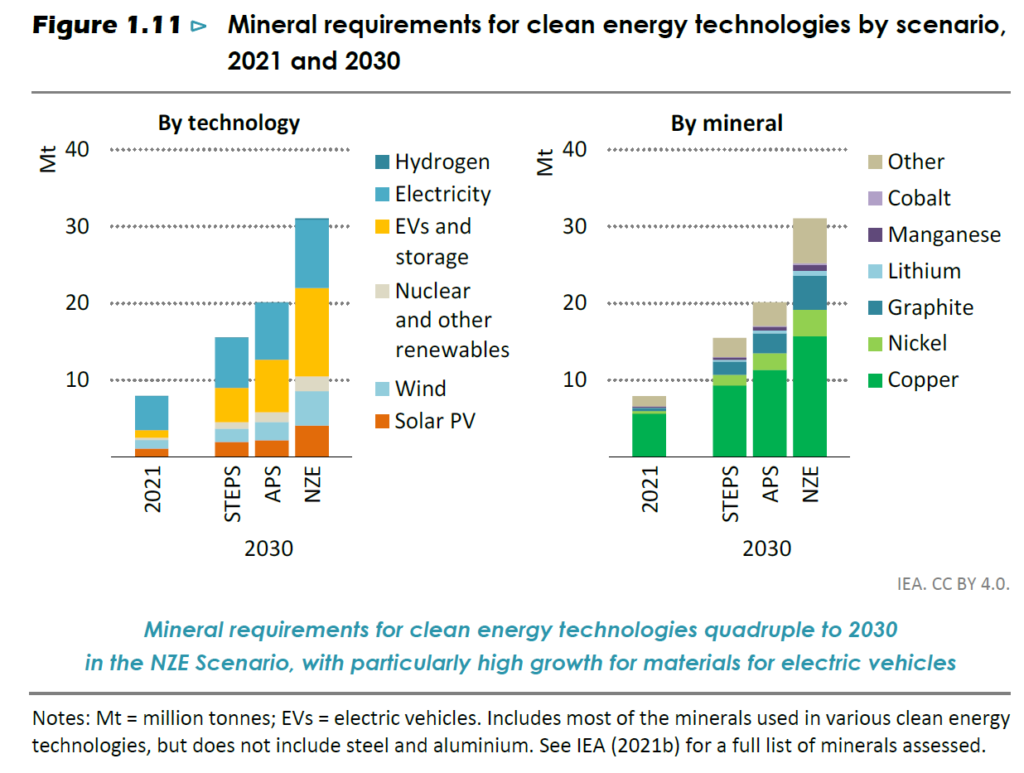

Critical Minerals Requirements Increase

There’s no EV transition without a substantial increase in the use of critical minerals. IEA notes that demand for critical minerals for clean energy technologies is set to rise two to fourfold by 2030 (depending on the scenario) as a result of the expanding deployment of renewables, EVs, battery storage and electricity networks. This is shown in the figure below.

Biofuels

In the NZE Scenario, around 90% of liquid biofuels produced in 2050 are advanced biofuels and 75% are consumed in aviation and shipping. More than 40% of the fuel used in aviation in 2050 takes the form of liquid biofuels, according to the WEO. The figure below shows liquid biofuel demand and supply for each scenario through 2050.

Hydrogen

Low‐emissions hydrogen‐based liquid fuels include ammonia, methanol and other synthetic liquid hydrocarbons made from hydrogen with very low‐emissions intensity. The chart below shows the WEO outlook for the three scenarios through 2050. IEA notes, “Progress between 2030 and 2050 obviously depends crucially on what is achieved by 2030, including on deployment, innovation and economies of scale that help to narrow the cost gap with oil products, as well as on standards.”

The Hill: Decarbonization of US Aviation Sector ‘within Reach’: Study – Planting grass on unused agricultural lands could provide the U.S. with enough biomass feedstock to meet the liquid fuel demands of the country’s aviation sector, this article notes, highlighting a new study published in Nature Sustainability. Such a strategy could pave the way toward the full decarbonization of U.S. aviation fuel by swapping conventional jet fuel with sustainably generated biofuels.

Researchers explained that feedstock for these biofuels would be produced by miscanthus across 23.2 million hectares, or 57.3 million acres — roughly the size of Wyoming – on “existing marginal agricultural lands” (land that is poor in soil quality or often lays fallow). This could provide enough biomass to meet the U.S. aviation sector’s liquid fuel needs, which are expected to reach 30 billion gallons per year by 2040, according to the study.

Miscanthus ended up being the more promising feedstock, as fuels derived from this type of grass could meet the 30 billion gallons per year target at an average cost of $4.10 per gallon, the researchers found.

While this is a higher average price than that of conventional jet fuel, usually about $2 per gallon, the scientists concluded that this was a reasonable threshold when accounting for the potential to curb emissions. I would add, throw in the SAF tax credit from the recently enacted Inflation Reduction Act (IRA) and it becomes nearly on a par with conventional jet fuel.

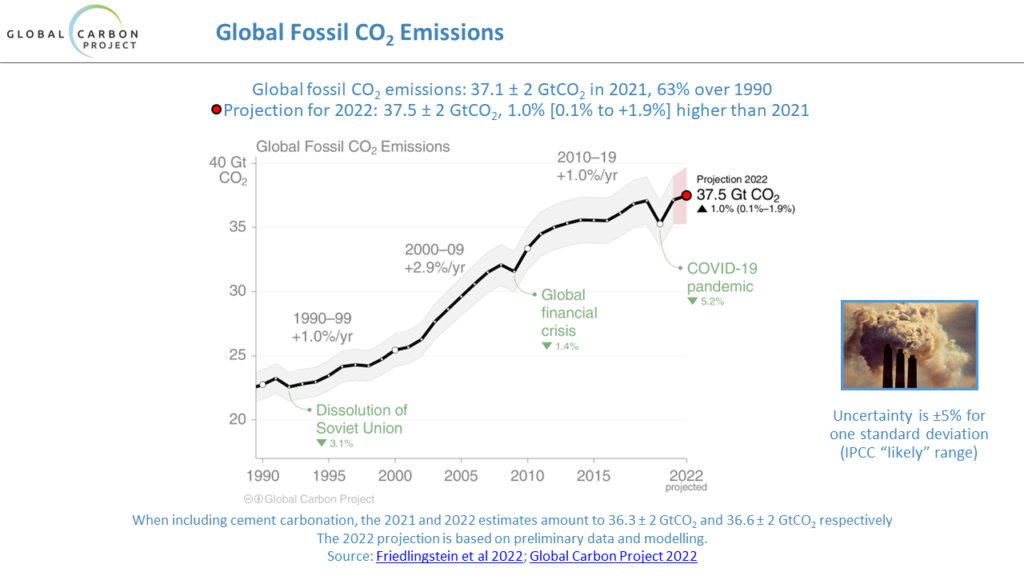

Center for International Climate Research: Global Fossil CO2 Emissions Increase Amidst Turmoil in Energy Markets – The Global Carbon Project (GCP) published its annual analysis of trends in the global carbon including an updated full-year projection for 2022. Global fossil CO2 emissions are expected to grow 1.0% (with an uncertainty range of 0.1% to 1.9%) in 2022 as the COVID recovery continues amidst turmoil in energy markets. This is shown in the figure below.

Growth in oil use, particularly aviation, and coal use are behind most of the increase in 2022, according to the authors, noting specifically that:

Some key findings also include:

Wall Street Journal: Start Ups Startups Look for Ways to Bring Down the Cost of Green Hydrogen – This article takes a look at several start ups that aim to bring the cost of hydrogen down by either improving electrolyzers or developing new methods to produce hydrogen. Sunfire GmbH, a German manufacturer, has developed a way of using steam instead of liquid water, tapping heat from industrial processes. Hysata, an Australian start up, was cited as another example.

Another company highlighted in the article, Cemvita, plans to capitalize on oil that is still in the ground by taking over old wells and injecting oil-metabolizing microbes into subterranean rock. The microbes, according to the company, turn the oil into carbon, which would stay underground. The hydrogen gas released, meanwhile, would rise to the surface to be captured.

Monolith, a U.S. start up, plans to commercialize a method of making “turquoise” hydrogen called methane pyrolysis. Like the conventional hydrogen-production process, hydrogen pyrolysis starts with methane, the main component in natural gas. But instead of burning gas to make hydrogen and carbon dioxide, the process uses electricity to generate heat in a reactor and turn methane into carbon black—a product that can be sold for uses such as making tire filler—and hydrogen.

Green hydrogen currently costs between approximately $3 per kilo and $26 per kilo, according to data from S&P Global. The U.S. Department of Energy (DOE) has said it needs to cost about $1 per kilo to unlock new industrial applications. The Hydrogen Council, an industry group, says the cost of making hydrogen with electrolyzers could fall to $1.40 a kilogram by 2030 in the right circumstances, such as renewable electricity being available for as little as $13 per megawatt hour.

But while it has become cheaper, renewable electricity costs a lot more than that, the article notes. During the first half of 2022, according to BloombergNEF, power from new utility-scale solar and onshore wind facilities on average cost $45 per megawatt-hour and $46 per megawatt-hour, respectively. Even the cheapest renewable power, from Brazilian wind farms, cost $19 per megawatt-hour.

Hydrogen was covered in a wide-ranging series for Transport Energy Outlook members this year. They can access various reports and posts at this link.

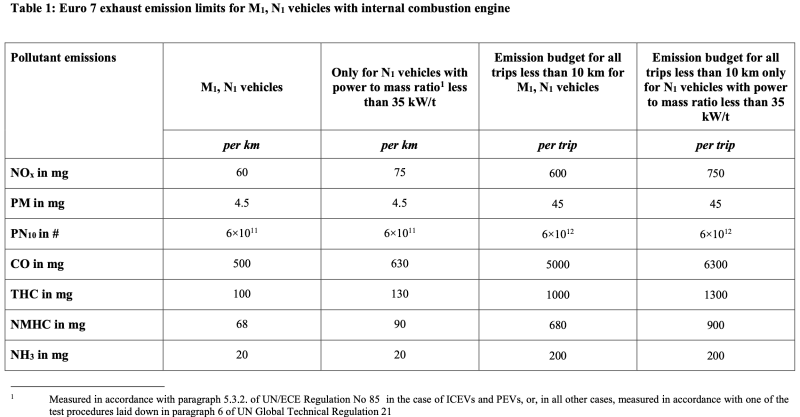

European Commission: Commission Proposes New Euro 7 Standards to Reduce Pollutant Emissions from Vehicles and Improve Air Quality – The Commission released its proposal for Euro 7 standards last week. By 2035, all cars and vans sold in the EU must zero CO2 emissions under the proposal that was agreed by the European Council on October 27. However, the Commission highlights that in 2050, more than 20% of cars and vans and more than half of the heavier vehicles are expected to continue to emit pollutants from the tailpipe. Battery electric vehicles also still cause pollution from brakes and microplastics from tires.

The Euro 7 rules aim to reduce all these emissions and keep vehicles affordable to consumers, the EC said. The table below summarizes the standards.

Source: European Commission, November 2022

In 2035, Euro 7 will lower total NOx emissions from cars and vans by 35% compared to Euro 6, and by 56% compared to Euro VI from buses and trucks. At the same time, particles from the tailpipe will be lowered by 13% from cars and vans, and 39% from buses and lorries, while particles from the brakes of a car will be lowered by 27%.

Tammy Klein is a consultant and strategic advisor providing market and policy intelligence and analysis on transport energy to the auto and oil industries, alternative fuels industries, governments and NGOs. She writes and advises on petroleum fuels, biofuels and other alternative fuels, and fuels policy, market and technology issues.