In the fierce marketing battle to convince motorists to purchase a more expensive electric vehicle (EV) to replace their existing internal combustion engine vehicle (ICEV) — under the threat of eventually being banned from European roads, if the Commission manages to impose its climate strategy, in densely urbanized areas’ Zero Emission Zones sooner than that — the Total Cost of Operation (TCO) is the main economic argument, if the motorist is not already convinced by the environmental or climate-friendly one, to cough up several additional thousands of Euros for a similar mobility service: namely, because electricity is cheaper than liquid fuels. Today.

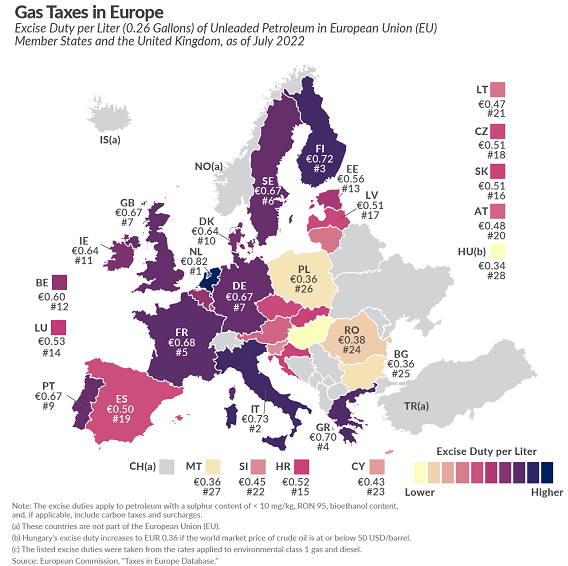

Mostly because road fuels have been a soft and easy target for taxation, a captive market one could say, and some countries in Europe do tax, up to 2/3 of the final price at the pump, as this chart shows.

For the rest of my demonstration, I will focus on France, where the taxes represent some 60% of the road fuels average selling price, VAT included, bringing a whooping 40 G€ in the government coffers every year, more than half of the income tax. Such a contribution toward a stressed national budget cannot disappear all of a sudden and cannot easily be replaced, especially when the government creed is not to increase the tax burden, one of the highest in the Western world, in a context where demand for public spending increases, for education, for healthcare, for pensions, for energy transition, to name a few.

Taxes on electricity, 35% of the electron commercial price for households, only bring 16 G€, not so surprising in a country that promoted electricity for heating alongside its nuclear program of the 70es and 80es. Calculations have been made regarding the impact of a full replacement of the ICEV car pool by EVs: the additional electricity demand, if not concentrated at peak time, would be manageable by the electricity production system and the grid, but, at current taxation level, only 3 G€ would accrue to the government revenues from electromobility. 3 vs 40 from mobility? We have a problem, two options:

Option 1: Sprinkle the missing 40 G€ of missing liquid fuel taxes on the average electricity price, another captive market, anyway: electricity price for households would roughly double, taxes increasing toward 2/3 of the price, and that is, assuming the production cost does not increase, not guaranteed as infrastructure investment for intermittent renewable electricity could more than offset the production cost itself. A good recipe for social unrest.

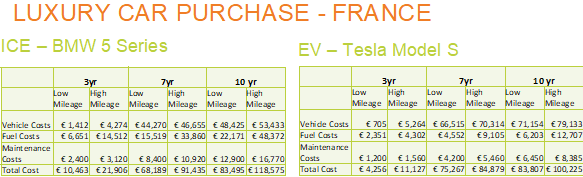

Option 2: In a laudable effort of social justice, only electricity used for EVs bears the 40 G€ burden of transferred taxation. Technically, the smart metering technology allows to discriminate between end-uses at home, and a powerful charging station for an EV is anyway usually bespoke. But the average price for motorists would then be multiplied by 5, compared to today. Not sure the TCO is so attractive, in that case, just take a look at the worst-case scenario for ICEV vs EV TCO comparison (from a 2021 study by Avicenne Energy for the Nickel Institute), namely high mileage over 10 years for the luxury car segment. If the electricity price is multiplied by 5, the Tesla S TCO would top 150,000 €, significantly higher than the 118,575 € of the “thermal” BMW Series 5 equivalent model.

Source: Avicenne Energy/Nickel Institute, January 2021

No need to jump to conclusions, as the massive use of EVs is still way out in the future, and one can only speculate what the national budgets will look like then. But let us not forget that energy is the most taxed product or service today. In the G7 group of advanced economies, 46% of taxes come from energy. My point is that the commercial argument of a lower TCO may be misleading when using the present price of electricity, especially as motorists invest for many years, EVs projected to stay longer on the roads, be it from lower driving or sturdier technology. A point of attention, that’s all.

Philippe Marchand is a Bioenergy Steering Committee Member of the European Technology and Innovation Platform (ETIP).