Hello friends! Here’s my monthly take on five most interesting developments in transport energy trends. What I try to do each month is select stories, studies and other interesting items that you may not have seen elsewhere but that really represents an important issue or trend that I think you would want to know about. Or I try to poke behind the hype to provide a deeper understanding of what’s happening. Items I selected this month include:

1. Bloomberg: Clean Energy Has a Tipping Point, and 87 Countries Have Reached It – This article from Bloomberg Green identifies tipping points for 10 clean-energy technologies, from electric motorcycles to heat pumps and rooftop solar panels. New analysis shows which countries have crossed the threshold and how quickly those markets then expanded. The central thesis from the authors is this:

“Five percent isn’t a universal tipping point. Some technologies flip sooner, others later, but the basic idea is the same: Once the tough investments in manufacturing have been made and consumer preferences start to shift, the first wave of adoption sets the conditions to go much bigger. By examining the countries that reach each tipping point first, we begin to get a sense of what to expect from those that follow.”

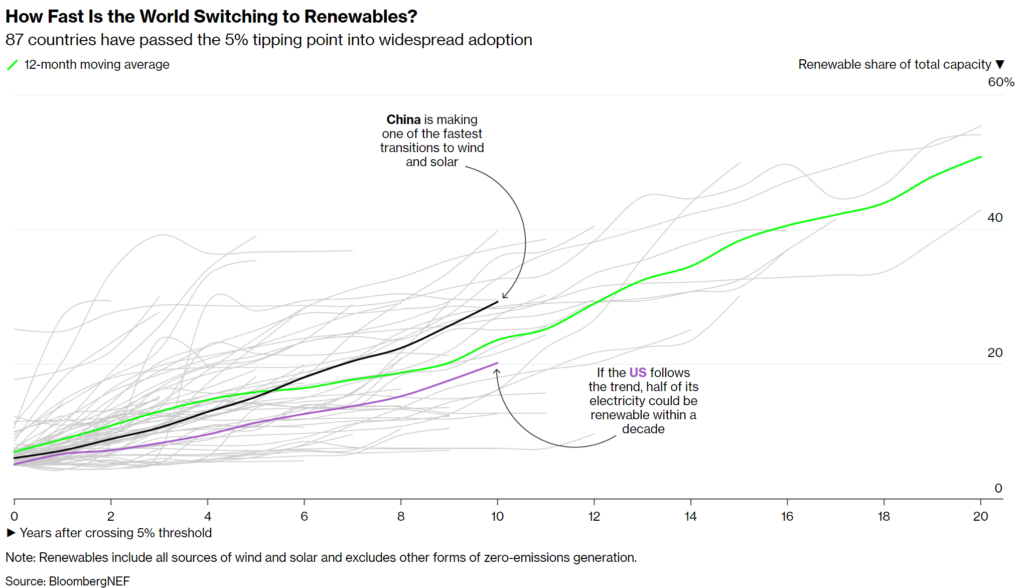

First up: The transition to clean energy, now approaching full speed with 87 countries drawing at least 5% of their electricity from wind and solar, shown in the figure below. The article notes that as more countries tipped into mass adoption, wind and solar became the cheapest sources of new electricity capacity worldwide. Cost declined so much that it’s no longer the biggest obstacle to expansion. Instead, it’s permitting, interconnecting and central planning around grids.

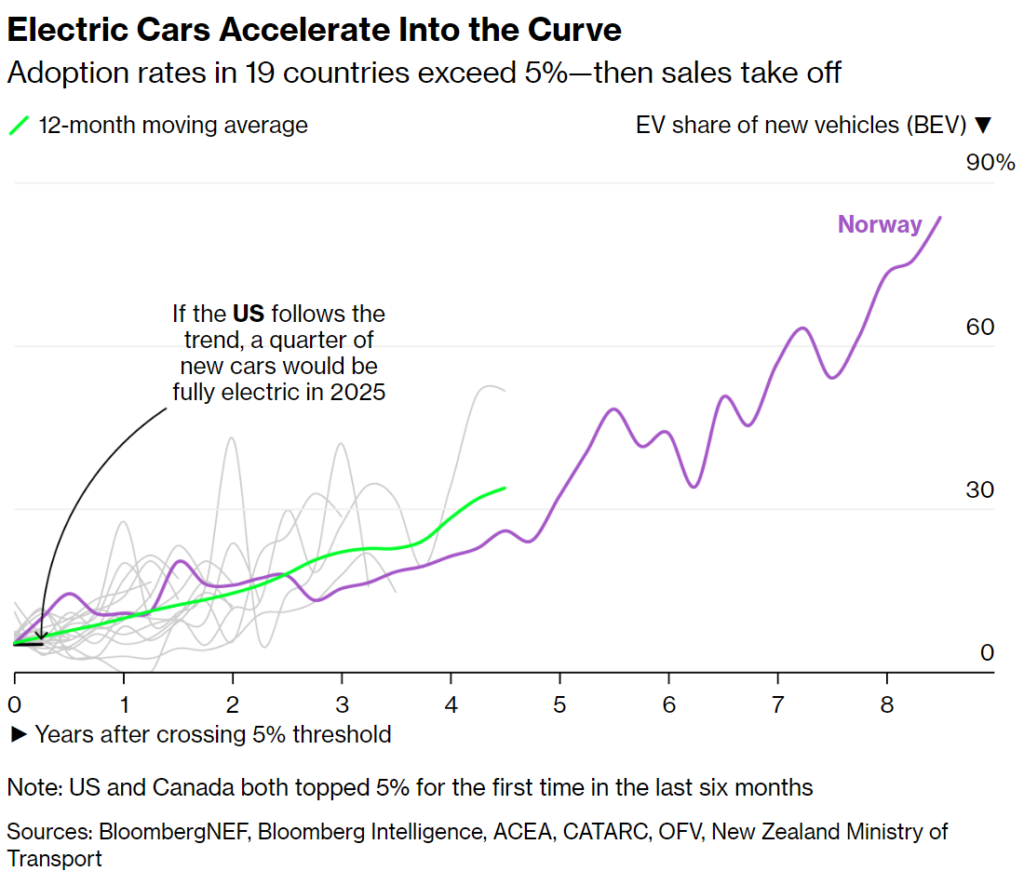

Another “5% example” is the U.S.’ reaching 5% EV sales, shown in the figure below. The article notes that if the US follows the trend established by 18 countries that preceded it, a quarter of new car sales could be electric by the end of 2025. The author notes, “It’s reasonable to expect a similar EV tipping point around the world, since most impediments are universal: not enough chargers, expensive sticker prices, and a lack of consumer awareness. The 5% threshold is where these obstacles give way.” We’ll see if they are right.

What about plug-in hybrids? The article notes that if the category from battery-only cars is expanded to include plug-in hybrids there are more than 20 million electric vehicles on the road or roughly 2% of the total fleet. BloombergNEF projects that figure will double again by the end of next year. The article notes that in Europe, once 10% of an automaker’s quarterly sales go electric, the share of EVs triples in less than two years.

2. ICAO: States Adopt Net-Zero 2050 Global Aspirational Goal for International Flight Operations – UN aviation body the International Civil Aviation Organization (ICAO), agreed earlier this month to an “aspirational” goal of net-zero CO2 emissions by 2050. The sector is expected to rely heavily on offsets, but also on sustainable aviation fuel (SAF), innovative aircraft technologies and streamlined flight operations.

Countries agreed on a new Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) baseline from 2024 onwards, defined as 85% of CO2 emissions in 2019, and on revised percentages for the sectoral and individual growth factors to be used for the calculation of offsetting requirements from 2030 onwards. There are skeptics. Europe’s Transport & Environment NGO noted in a press released cited in Grist that, “This is not aviation’s Paris Agreement moment. Let’s not pretend that a non-binding goal will get aviation down to zero [emissions].”

While the push to convert America’s passenger cars to electric power is accelerating, the same transition for medium- and heavy-duty trucks has only begun. Truck makers say they can only move as quickly as the market allows, while environmentalists counter that these companies have already waited too long to electrify and will keep dragging their feet without hard deadlines.

3. The Washington Post: Truck Makers Tout An Electric Future. Privately, They’re Stalling It. – This article notes that while truck makers such as Volvo have set fossil free targets for their fleet, privately their trade association is pushing to weaken tougher federal and state regulations, such as California’s Advanced Clean Truck (ACT) program.

The U.S. Environmental Protection Agency (EPA) will decide by the end of this year whether to allow California to enforce its new truck rules. New Jersey, Massachusetts, New York, Oregon and Washington plan to adopt the ACT program, representing about 20% of the U.S. medium- and heavy-duty vehicle market. By 2035, zero-emission truck/chassis sales would need to be 55% of Class 2b-3 truck sales, 75% of Class 4-8 straight truck sales, and 40% of truck tractor sales under the ACT program.

Truck makers say they can only move as quickly as the market allows, while environmentalists counter that these companies have already waited too long to electrify and will keep dragging their feet without hard deadlines. There are more electric trucks in the market than ever (with more models coming) but there are issues: supply-chain snarls, the lack of a nationwide charging network and the fact that electric trucks are too costly for some buyers. That could impact truck makers’ ability to meet ACT requirements.

Meantime, a new report from Energy Innovation and featured in Protocol shows that the Inflation Reduction Act’s (IRA ) tax credits could double or even triple the share of electrified trucks and vans used in fleets by 2030 compared to business as usual. The IRA includes tax credits of up to $7,500 for light- and medium-duty vehicles and $40,000 for heavy-duty trucks.

Those credits don’t come with any requirements for where battery components and minerals can be sourced from or how much vehicles cost, unlike for passenger cars. Without any additional policies, 17% of new sales would be battery EVs by 2030. With the IRA, though, that percentage could rise to as high as 38%. Heavy-duty electric truck sales could nearly triple due to the IRA, reaching 27% by 2030.

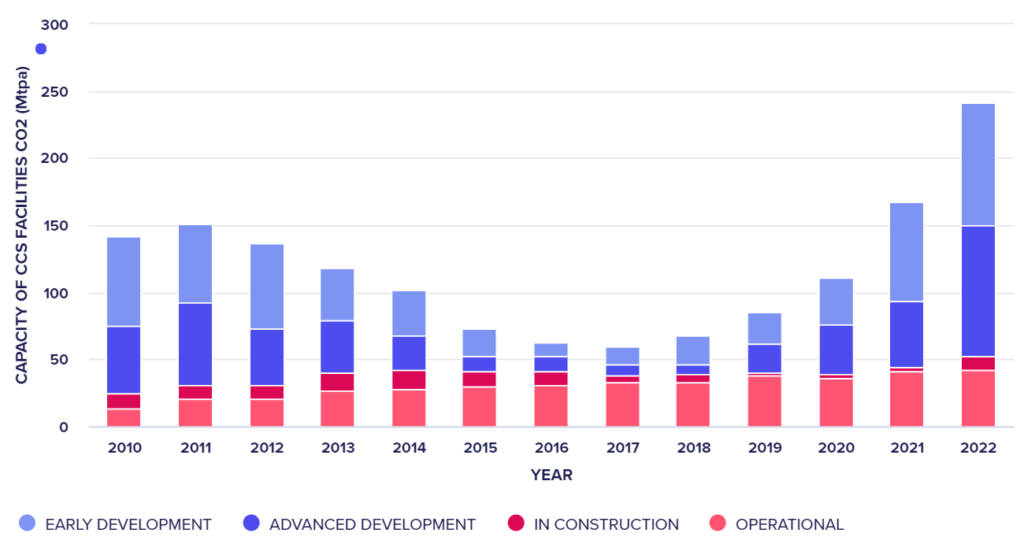

4. Reuters: Global Carbon Capture Project Pipeline Swells 44% in Past Year – The pipeline for projects to capture and store carbon emissions has grown around 44% in the past twelve months to 244 million tons a year, Reuters notes citing the just-released Global CCS Institute (GCCSI) annual report on carbon capture and storage (CCS) trends. Out of 196 projects, 30 are in operation, 11 under construction and 153 in development. Out of this pipeline, 32 projects are for enhanced oil recovery (EOR). The figure below summarizes commercial CCS facilities since 2010.

Pipeline of Commercial Facilities Since 2010 by Capture Capacity (Mtpa)

Source: Global CCS Institute, October 2022

I expect these numbers to grow even more substantially over the next few years, driven by policies such as the revised Section 45Q tax credit in the Inflation Reduction Act (IRA). The IRA both increased the value of the existing CCS tax credit and dropped the qualifying thresholds so that many more facilities can take the tax credit if they choose to develop a CCS project. Other developments around the world include the following, according to GCCSI:

5. EURACTIV: FuelEU Maritime Deal Lets Shipping Off the Hook – Members of the EU Parliament (MEP) Ciarán Cuffe and Jutta Paulus argue in this opinion piece that the FuelEU Maritime proposal under Fit for 55 fails to provide a target for carbon neutrality by 2050 while the proposal itself is being hollowed out and watered down “by narrowing the scope and introducing a myriad of exemptions.”

Among other issues, the MEPs note that there should be a 100% carbon neutrality target put in place. They also argue for higher targets for renewable fuels of non-biological origin (RFNBOs) hydrogen, methanol, ammonia, and e-diesel. They note: “We are proposing to increase the RFNBO sub-target introduced by TRAN from 2% by 2035 to 6%, in line with the ITRE target, although from a climate policy point of view, the much higher ENVI sub-targets of 6% and 12%, respectively, should be applied.”

The MEPs also take issue with the Transport Committee’s (TRAN) to restrict obligations to cut emissions of GHG and pollutants in harbors to Trans-European Transport Network (TEN-T) ports only. This significantly reduces the law’s potential provisions that aim to reduce ship emissions to zero at berth.

It remains to be seen what is going to happen on FuelEU Maritime, but I suspect these MEPs will not win the day. The original proposed regulation from the Commission introduces increasingly stringent limits on carbon intensity of the energy used by vessels from 2025, which should oblige them to use alternative fuels. It applies to commercial vessels of 5,000 gross tons and above, regardless of their flag (fishing ships are exempted). It covers all energy used on board when the ship is at an EU port and on voyages between EU ports, and 50% of the energy used on voyages departing from or arriving to an EU port. The annual average carbon intensity has to decrease by 2% in 2025 and by 6 % in 2030 and then further by 5-year periods till 2050, when carbon intensity should be 75% compared to the 2020 base year.

Tammy Klein is a consultant and strategic advisor providing market and policy intelligence and analysis on transport energy to the auto and oil industries, alternative fuels industries, governments and NGOs. She writes and advises on petroleum fuels, biofuels and other alternative fuels, and fuels policy, market and technology issues.