Hello friends! Here’s my monthly take on five most interesting developments in transport energy trends. What I try to do each month is select stories, studies and other interesting items that you may not have seen elsewhere but that really represents an important issue or trend that I think you would want to know about. Or I try to poke behind the hype to provide a deeper understanding of what’s happening. Items I selected this month include:

1. Green Car Congress: Study Finds Future-Fuel Demand for Shipping Industry Equal to Entire Current Global Production of Renewables – This article highlights findings from a study, Fuelling the Fourth Propulsion Revolution, commissioned by the International Chamber of Shipping and prepared by Professor Dr. Stefan Ulreich from Germany’s University of Applied Sciences. The study found that the global shipping industry will require the equivalent of the world’s entire current renewable energy demand in order to replace fossil fuel use.

To reach the industry’s 2050 (net) zero goal, shipping’s fuel needs would require electricity from renewable sources to increase by up to 3,000 TWh, equivalent of the entire world’s current renewable energy production. The report urgently calls for increased R&D in green fuels, and specifically to develop production infrastructure in key geographic locations such as Latin America and Africa. Estimates show a production potential of more than 10,000 TWh for (net) zero carbon fuels in coastal regions worldwide.

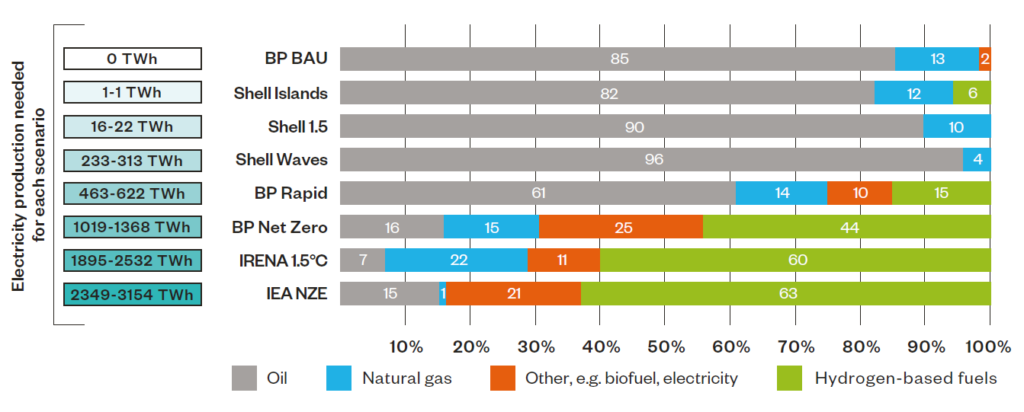

The headline centered around green fuels, but the report acknowledges that other fuels, such as natural gas and biofuels will play a role in future fuels for shipping as well. “The maritime industry’s green transition will take time and consist of a multi-fuel future as there is no single replacement for affordable and readily available current fossil fuels. Biofuels, e-fuels, natural gas and hydrogen derivatives are all likely to play a role in the future fuel mix for shipping.” The figure below summarizes scenarios from other organizations discussed in the report and shows that hydrogen (or synfuel-based derivatives) play a strong role in net-zero scenarios. However, biofuels, electricity and natural gas do as well.

Source: International Chamber of Shipping citing scenarios from named organizations, May 2022

The study also notes that the shipping sector will compete with other fuels for net zero carbon fuels with other sectors. It’s not a slam dunk. Moreover, and as the study notes, using and transporting these new fuels comes with significant operational and safety challenges that need to be addressed. One is the need to define and agree global safety and sustainability standards for hydrogen-based fuels and strong safety standards for the transport and use of (net) zero fuels must be developed quickly.

Another is that production facilities for new bunkering fuels need to be within easy access of ports, unless future technologies and bunkering systems permit otherwise. Investment needs to increase, but actually declined $2.7 billion in 2017 to $1.6 billion in 2019.

What about biofuels? The study notes that “with annual fuel consumption of 330Mt for maritime fuels and 220Mt for aviation fuels – i.e., 550Mt in total – biofuels could in slightly optimistic scenarios cover the fuel demand of maritime transport and aviation. However, this also means that biofuels would not be used for other purposes such as road transport, heating/cooling and electricity production.” The study finds that biofuels could play an important role in maritime transport but would not be a single fuel for decarbonization unless the following solutions were deployed:

We’ll be talking more about the future of biodiesel and the role that it can play in decarbonizing shipping on June 22 from 10-12 Eastern (4-6 Brussels time). To learn more, contact me.

2. Reuters: EU Lawmakers Back Effective Ban on New Fossil-Fuel Cars from 2035 – Lawmakers on the European Parliament’s Environment Committee earlier this month approved an EU Commission plan under Fit for 55 that would set a 100% cut in CO2 emissions by 2035 from cars, which would effectively ban the internal combustion engine vehicle (ICEV). “With CO2 standards, we create clarity for the car industry and stimulate innovation and investments for car manufacturers,” said Jan Huitema, the lead lawmaker on the policy, telling Reuters that the move should make driving electric vehicles cheaper.

The whole European Parliament will vote on the proposal this year, and after a trilogue negotiation and final approval will take place as among the Commission, Parliament and Council of the European Union, representing the Prime Ministers of each of the EU-27 member states. Other countries have announced the intention to either outright ban or require a 100% zero emissions vehicle (ZEV) requirement, which refers to zero tailpipe emissions and generally encompasses battery electric (BEV), plug-in hybrid (PHEV) and hydrogen fuel cell electric (FCEV) vehicles. My review of country policies, statements and intentions find that hybrids are generally excluded from the ZEV definition.

Most of these countries are actually in the EU, and a number of them had already announced an intention (not actual enforceable policy) to ban the ICEV by 2030, including: Denmark, Iceland, Ireland, Portugal, Scotland (2032), Slovenia and Sweden. The EU-wide requirement under consideration avoids the “ban” terminology while effectively doing so and pushes out by five years the bans that had already been announced in the foregoing countries. It is five more years as well to develop and expand EV charging infrastructure. Notably, France’s ban, which is legislated (but with no enforcement requirements), is scheduled for 2040; for the Netherlands, 2045; for Spain, 2050. The 100% CO2 reduction requirement also sidesteps another issue: whether member states actually had the legal authority to implement a ban.

The Commission is also considering a proposal that would require the installation of EV charging at regular intervals in major corridors. Incidentally, I’ve heard a lot about the “EU example” of getting it right in charging and that the EU is ahead of the U.S. in this regard. I am not sure that is true at all, at least not EU-wide. The issues that exist in the U.S. right now with respect to charging are also at play in the EU, in particular, that “chicken and egg” problem of getting the charging in place before it is really profitable to do so before and as EVs scale up. There are other issues as well.

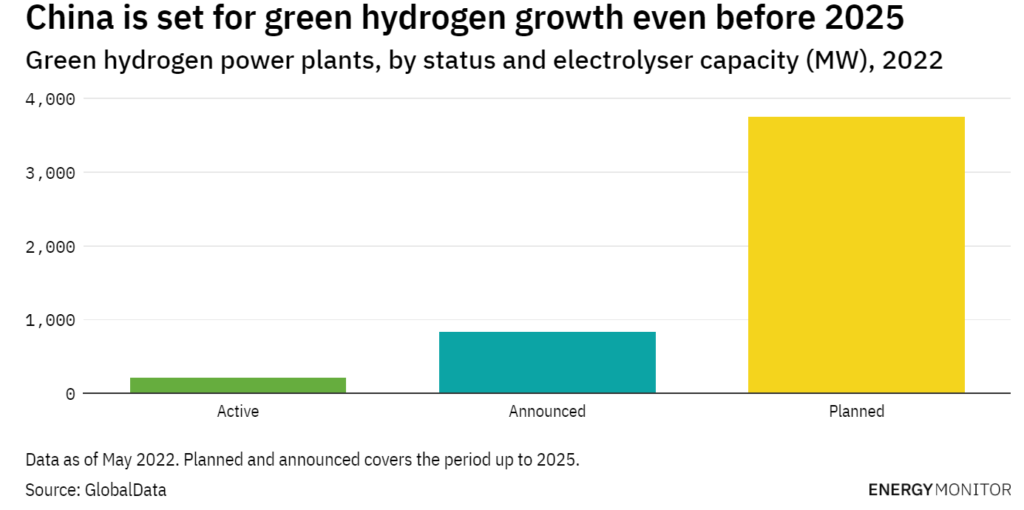

3. Energy Monitor: China Readies for Post-2025 Green Hydrogen Boom – China recently rolled out a hydrogen development plan through 2035 that specifies targets for green hydrogen, discussed in this Energy Monitor article. The goals set out in the plan see China producing 100,000–200,000 metric tons of green hydrogen annually along with a total of 50,000 hydrogen FCEVs by 2025. Currently, China leads the world in hydrogen production – most of that created through coal-fired power – at 33 million metric tons per year. The figure below summarizes the green hydrogen targets.

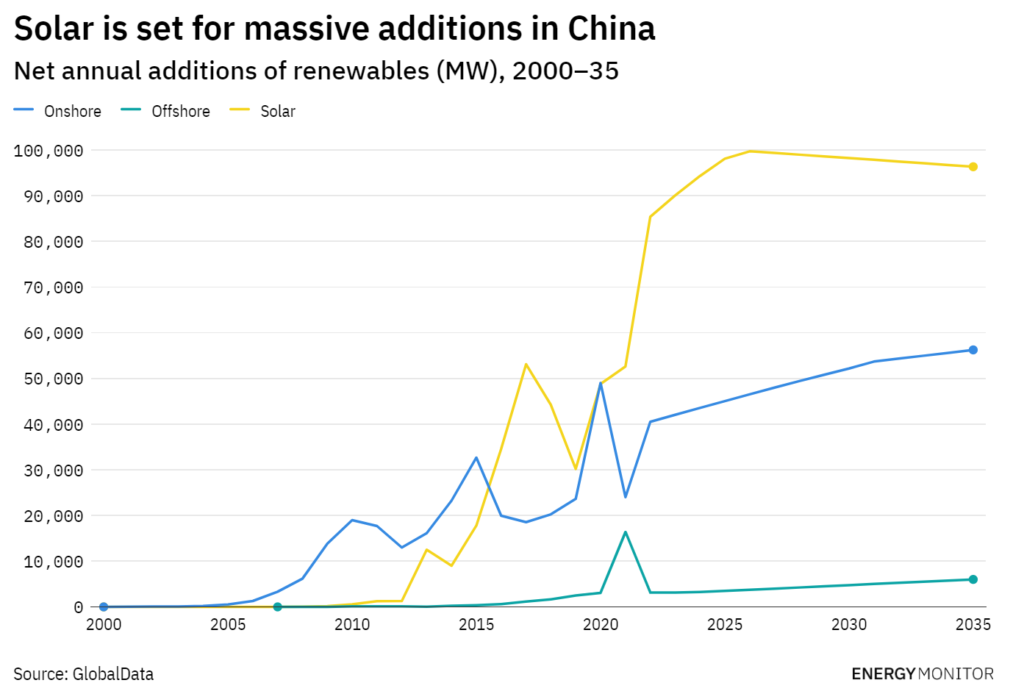

As this article notes, the targets are rather modest – but that is apparently purposeful. The government is focused on scaling up renewable electricity, particularly solar. The figure below presents a projection for renewables through 2035.

One expert cited in the article expects that by 2030, China will have 1TW of renewable production and that green hydrogen is the most promising alternative for storage. By that time, China hopes to have solved its initial energy market reform hurdles that have slowed renewables’ uptake into the country’s grids, creating more room for green hydrogen production. As I noted to Transport Energy Outlook members last month, the race to dominate is on for hydrogen and for green hydrogen in particular and other countries besides China (40 of them, in fact) are setting national strategies to

4. Associated Press: GOP Directs Culture War Fury Toward Green Investing Trend – If you’ve seen any of my recent posts (such as post Apr. 25, 2022), you’ll know that I’ve wondered whether there would be increasing Republican backlash over environment, social and governance (ESG) initiatives in the U.S. Turns out the answer to that question is yes. Example: Earlier this month, former U.S. Vice President Mike Pence attacked ESG outright in a speech in Houston. Most of us have probably read about Tesla CEO Elon Musk’s Twitter railing against ESG following the company’s removal from the S&P ESG Index.

The article notes that in more than a dozen Republican-dominated states, officials dispute the idea that the energy transition underway could make fossil fuel-related investments riskier in the long term. They argue employing asset managers with a preference for green investments uses state funds to further agendas out of sync with constituents. Moreover, investors making carbon-neutral or net-zero criteria could limit access to capital for oil and gas businesses, hurting their returns and potentially contributing to gas price spikes.

In Texas, West Virginia and Kentucky, lawmakers have passed bills requiring state funds limit transactions with companies that shun fossil fuels. Wyoming considered banning “social credit scores” that evaluate businesses using criteria that differ from accounting and other financial metrics, like ESG. West Virginia and Arkansas recently divested their pension funds from BlackRock in response to the asset manager adding businesses with smaller carbon footprints to its portfolios. Moore, West Virginia’s treasurer, hopes more will follow.

These Republican efforts might throw a wrench in to ESG efforts but are not likely to derail them. As noted by Jeff Hove at the Fuels Institute in a note this month, the U.S. Securities and Exchange Commission (SEC) has proposed rules that may be finalized as early as December 2022 that would directly apply to publicly traded companies and indirectly apply to privately held organizations doing business with publicly traded companies. In another note, Jeff highlights that under the proposed rules, phased-in requirements will put new reporting requirements directly on publicly traded companies. The SEC will not only require these companies to provide their direct CO2e emissions (Scope 1), but also includes the reporting of all indirect emissions (Scope 3). As written, ESG requirements will touch every organization that is in the supply chain, Jeff notes.

5. Bloomberg: California’s $19 Billion Carbon Market Falls Short in Fight to Curb Emissions – Nearly 10 years after “cap and trade” began, this article notes there hasn’t been much of a direct impact on GHG emissions. As officials debate how to reach the state’s goal of zeroing out emissions by 2045, critics on both sides of the political spectrum say the market isn’t working.

California’s cap-and-trade system sets an annual limit—the cap—on the amount of emissions the state’s economy can produce. The cap gets tighter every year, lowering emissions. Companies buy an allowance for each ton they emit, purchasing these permits through quarterly state auctions or from a secondary market. Allowances in that marketplace are trading at $30.73, up about 50% in the last year, according to Bloomberg. Critics say the cap isn’t tough enough and is serving, in the case of fuels, to increase prices at a time with already increasing fuel prices. Most of the emissions reductions to date are coming from power generation, not transportation.

Tammy Klein is a consultant and strategic advisor providing market and policy intelligence and analysis on transport energy to the auto and oil industries, alternative fuels industries, governments and NGOs. She writes and advises on petroleum fuels, biofuels and other alternative fuels, and fuels policy, market and technology issues.