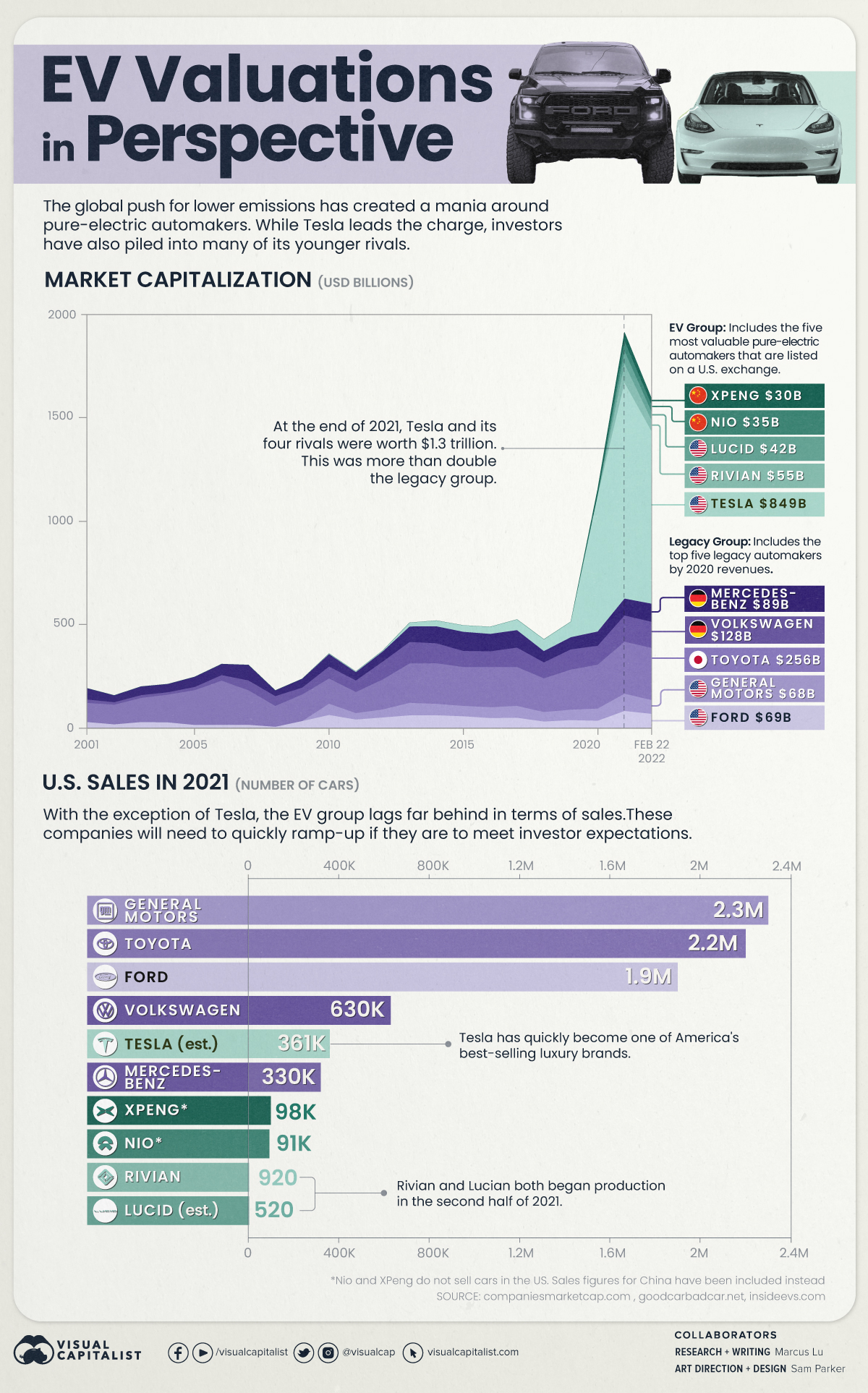

The global push for lower emissions has created a mania around pure-electric automakers. While Tesla leads the charge, institutional investors have also piled into many of its younger rivals.

For example, in 2019, Saudi Arabia’s sovereign wealth fund invested $1.3 billion into Lucid Motors. One year later, it was revealed that Amazon had a 20% stake (worth $3.8B) in Rivian.

To see how quickly EV valuations have ballooned, we’ve visualized the historical market capitalizations (market caps) of 10 prominent automakers.

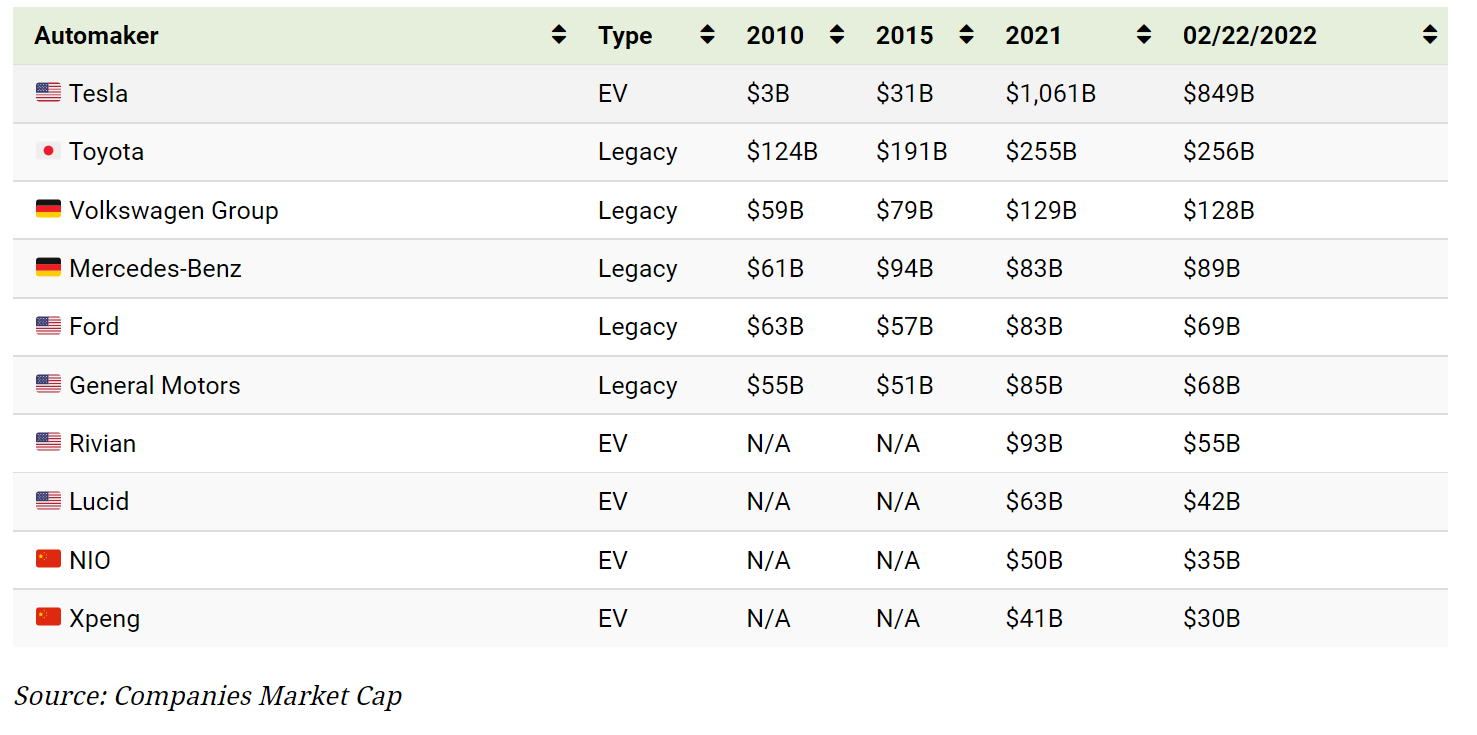

The legacy group includes five top traditional automakers, while the EV group includes the five most valuable pure-electric automakers that are listed on an American exchange. The following table lists the market caps of these companies at various dates.

At the end of 2021, Tesla and its four EV rivals were worth a combined $1.3 trillion. This was more than double of the legacy group, which was worth $635 billion. EV valuations have cooled since then, though Tesla is still the world’s most valuable automaker by a significant margin.

To satisfy investor expectations, Rivian and Lucid will need to rapidly scale their production and sales. Failing to do so could lead to significant stock price volatility.

Investors should also note that both companies could experience similar challenges as Tesla, which Musk has referred to as “production hell”. Rivian has already pushed back deliveries of its first SUV, while Lucid customers have been notified of delays due to “fit and finish” issues.

Nevertheless, these young manufacturers are setting some serious goals. Rivian aims to produce one million cars annually by the year 2030, while Lucid is targeting a more conservative 49,000 cars in 2023.

Tesla is still the undisputed EV leader, but competition is rapidly heating up.

On one hand, legacy automakers have been investing heavily in EV development, and new models are coming en masse. The Volkswagen Group is the biggest threat, selling 453,000 EVs globally in 2021 (up 96% over 2020). For reference, Tesla reported global sales of 936,000 in 2021.

On the other hand, Tesla must also defend its market share from an onslaught of Chinese entrants. This includes XPeng and NIO, which appear to be on similar trajectories. Both firms were founded in 2014, both sold nearly 100,000 EVs in 2021, and both have recently expanded into European markets. A U.S. expansion also seems to be imminent.

With the entire auto industry moving towards battery powered vehicles, will the market rethink its valuation of Tesla?

Original post at this link.