Gig economy, synonymous of temporary and flexible jobs (Wikipedia)

One of my Swedish friends, a quite pragmatic person, just asked this inconvenient question in an EU forum: How can you convince anyone to invest in a technology that soon will be made redundant? The technology, actually the technologies, in question, aims at producing alternative and sustainable, low-carbon, liquid fuels, often qualified as advanced biofuels, to accompany road transport toward zero net emissions (NZE), full decarbonization, toward 2050, when electric-powered cars (EV) and light trucks, and hydrogen-powered trucks and other heavy commercial vehicles, are supposed to have fully replaced the internal combustion engine (ICE) vehicles on the roads, a vision at the heart of every NZE strategy today.

Good question: we are getting into 2022 and the life prospect for these low-carbon fuels, assuming they can become mature and be produced on a large scale this very decade, would then be less than 25 years.

Now, consider this: most U.S. oil refineries are between 50 and 120 years old, average just south of 50, and, having been properly maintained and regularly upgraded, they do run as clockwork, hopefully for U.S. motorists. The fuels industry is not in the play for a few years, it is heavy, and not a big fan of a fast Schumpeterian behavior.

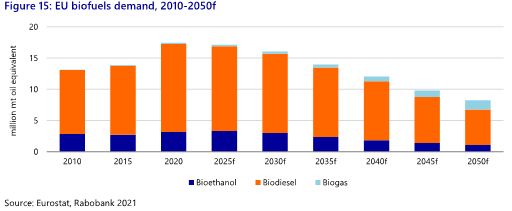

And what about this newest perspective for the EU biofuels industry, provided by Rabobank, the usual source of financing for the industry? The figure below projects biofuels demand in the EU through 2050.

Note: Come 2050, liquid fuels do not completely disappear from EU roads in this study, their volume is divided by three compared to 2020, as commercial transport and second-hand cars still rely on diesel and gasoline.

Coming back to the graph above, if these projections do materialize, the existing 35 million ton per year first-generation biofuel capacity in the EU would see its utilization rate drop to 20 % by 2050, assuming no advanced biofuels. Who can believe this industry, still young in the EU, would be eager to invest in the next technological step, advanced biofuels? One even wonders how the renewable diesel (HVO) capacity can keep on increasing this decade. (Hint: the oil refining industry is adapting some of its idle capacity to biorefining)? And would financial institutions loan money to such a short-lived adventure? Sure, banks are vocal in their support of the energy transition, but mostly in favor of the fashionable fuels of the future: renewable electricity and hydrogen.

We may have ambitious regulations in the EU about decarbonizing transport for 2030 and beyond, but what will the Commission do if investments in renewable fuels do not show up? Adapt its ambitions, I would say, and hopefully not resort to authoritarian transport reduction, so dear to the de-growth zealots.

Is doom certain for low-carbon liquid fuels or is there still some hope? There is, for three reasons, at least.

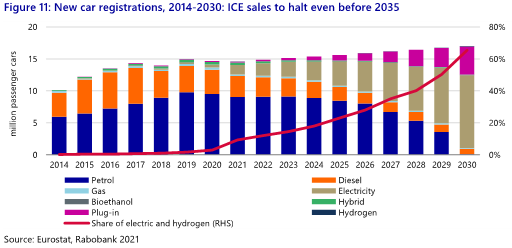

First, the ICE replacement rate. In the study mentioned above, the biofuel incorporation reduces dramatically, as, notwithstanding the continuous energy efficiency improvement of the ICE, the road vehicle pool upheaval is amazing, as can be seen in the following graph, showing no ICEV sale in 2030.

This simulation is much more optimistic than others, from the EU Commission itself or from the IEA. Should the EV uptake be more modest, for instance if car manufacturers face a severe rare metals supply crunch or if motorists balk at the lack of ubiquitous recharging network, the ICEV resilience could prove more robust and liquid fuels remain a staple food for transport, way beyond 2050.

Second, the EU has neighbors on the continent, in Africa and the Middle-East, that do not share the same ambition frenzy for transport decarbonization. ICEV could well find there a resilience in the second-hand market. Exporting biofuels would then be a way to mitigate our sin of exporting our vice to maintain our virtue at home. Haven’t we done the same with globalization, reducing GHG emissions in the West and letting the less advanced countries become the world manufacturers and leading GHG emitters?

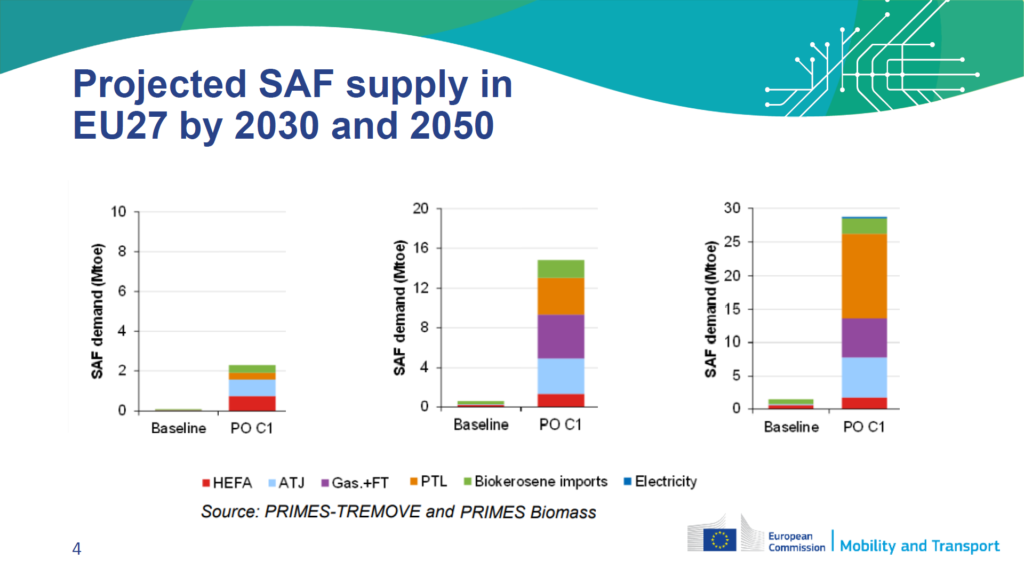

Third, there is a virgin market of Sustainable Aviation Fuels. Decarbonization of air transport is challenging, still, the EU aims at 63% low-carbon aviation fuels by 2050 according to a EU Commission-sponsored “ReFuel EU Aviation” study predicting biofuels to contribute in volume the equivalent of the 2020 demand for road, with a significant role for the alcohol-to-jet pathway, meaning not only could renewable diesel HVO be replaced by HEFA, limited by sustainable lipid supply, but ethanol could also find a new outlet.

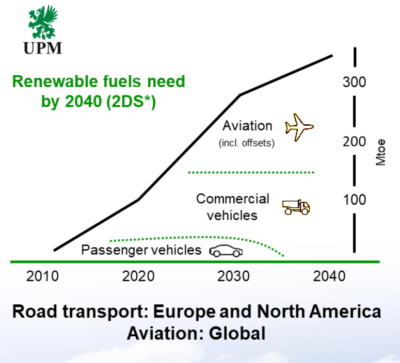

So, no, maybe there is a future for the low-carbon fuels industry that would not downgrade this existing transition solution into the gig economy category, and I would conclude with this graph of hope, supplied by a leader in biomass usage, UPM, from Finland, a country that is serious about responsibility.

Philippe Marchand is a Bioenergy Steering Committee Member of the European Technology and Innovation Platform (ETIP).