Hello friends! Here’s my monthly take on five most interesting developments in fuels and vehicles trends. What I try to do each month is select stories, studies and other interesting items that you may not have seen elsewhere but that really represents an important issue or trend that I think you would want to know about. Or, I try to poke behind the hype to provide a deeper understanding of what’s happening. Items I selected this month include:

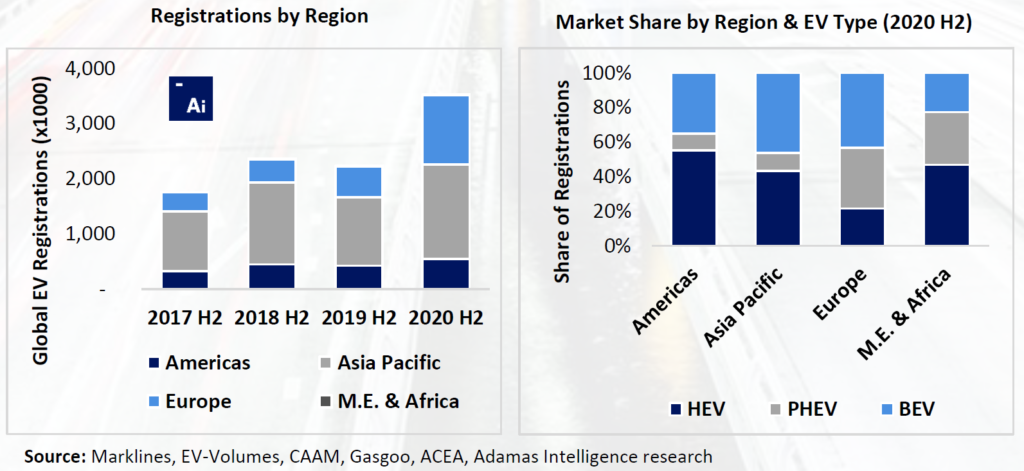

1. Adamas Intelligence (AI): State of Charge: EVs, Batteries and Battery Materials (2020 H2) – This biannual report, reviewing the second half of 2020 (AI refers to it as “2020 H2”), found that global passenger EV registrations grew by 58% versus the same period the year prior, amounting to 3.53 million units versus 2.24 million units in 2019 H2, shown in the figure below. A splash of buyer incentives in Europe launched EV sales 127% higher in 2020 H2 than the same period the year prior. In parallel, Asia Pacific posted a modest 38% gain, while in the Americas EV sales increased just 28% year-over-year, hindered by the second wave of the pandemic. We all know a lot about sales in the EU. What I find interesting and what you do not see in the public space very often is the estimate on hybrid sales (HEVs) and the figure below shows the majority of sales in the Americas, Middle East and Africa were HEVs.

Passenger EV Registrations

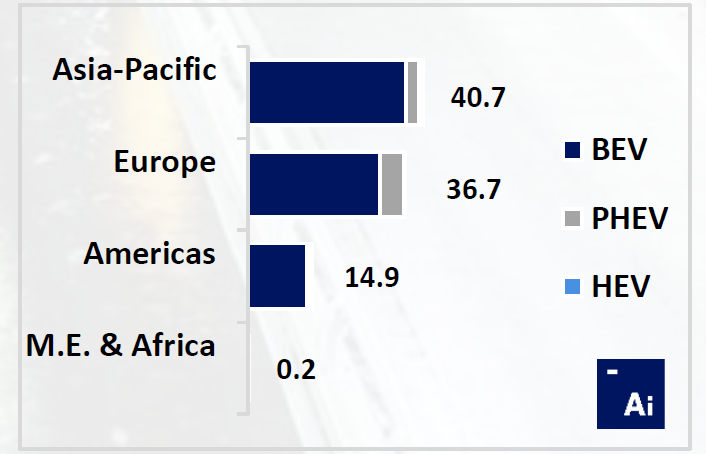

In 2020 H2, global battery capacity deployed in all newly sold passenger EVs combined amounted to 92.5 GWh, an increase of 93% over the same period the year prior, according to AI. Tesla deployed nearly as much battery capacity in 2020 H2 as its five closest competitors combined at 22.5 GWh. The figure below summarizes battery capacity deployed by region in H2, with Europe quickly gaining on Asia (and in particular, China).

GWh Deployed by Region & EV Type (2020 H2)

Source: Adamas Intelligence, 2021

Source: Adamas Intelligence, 2021

More than 57,300 tons of lithium carbonate equivalent (LCE) were deployed globally in batteries of all newly sold passenger EVs combined, 96% more than was deployed globally in 2019 H2. LCE deployment in NCM 6-Series cells amounted to more than 13,600 tons in 2020 H2 (up by more than 100% from 2019 H2), followed by NCM 5-Series (up by 52%), and NCM 8-Series (up by almost 200%). LCE deployment in NCA Gen 3 cells in 2020 H2 increased by 19% over the same period the year prior. Also, 53,150 tons of battery-grade nickel were deployed globally in batteries of all newly sold passenger EVs combined, 69% more than was deployed globally in 2019 H2.

2. Energy News Network: Group Reports Milestone in Tracking the Benefits of Renewable Gas Investments – This article discusses the creation of a thermal certificate for renewable natural gas (RNG or biogas) producers and buyers by M-RETS (formerly known as the Midwest Renewable Tracking System). Until now, there hasn’t been a uniform, method in the U.S. to track ownership of the environmental benefits related to RNG.

The article notes thermal certificate are expected to help track and verify the environmental benefits of RNG and that is expected to provide stability in the growing market, encouraging its use and investment, while also countering concerns by some environmental groups who say that RNG is effectively a pathway to ensuring the continuance of fossil fuel use and dominance.

The article also notes that the market for RNG continues to grow, and I agree. There is demand for it in both the transportation sector and the power generation sector. That it can actually be a net-negative fuel when produced by anaerobic digestion of food waste or dairy and hog manure, makes it an even more attractive alternative for these two sectors.

3. Reuters: Airline CEOs Urge White House Support for Greener Aviation Fuel – The CEOs of American Airlines, United Airlines and Delta Air Lines and other airline officials met virtually with White House in late February to discuss tackling aviation pollution and urge U.S. support for greener aviation fuel. United Airlines specifically asked the Administration to back incentives for SAF, which is about 3-4 times the cost of jet fuel currently. Hear what producers have to say about the policy directions for SAF in my recent video podcast series with them.

Meantime, according to Euractiv, a proposal known as “RefuelEU” is expected to be published this month mandating SAF for EU flights (whether the regulation ends up as intra-EU only or intercontinental remains to be seen). The proposal is likely to require airlines to use a set percentage of low-carbon sustainable aviation fuels, such as e-fuels or biofuels, in their fuel mix. Sources with knowledge of the upcoming proposal indicate that there will be an overall mandate covering SAFs, with a starting point of 2% in 2025, moving to 5% in 2030, 20% in 2035, 32% in 2040, and 63% in 2050. Penalties in case of non-compliance are also being considered, the same sources indicate.

4. Euractiv: EU Plotting Ban on Internal Combustion Engine as of 2025 – According to German trade association VDMA, representing the mechanical engineering industry, the Euro 7 regulations the European Commission is contemplating would amount to a back-door ban on internal combustion engine vehicles (ICEVs). The proposal regulation, thought to be the last before the EU transition to a totally zero emission future, would require virtually emission-free vehicles by 2025. The apparent consensus of both car trade groups, and individual auto companies is that those targets are nearly impossible to achieve – they would require a 60-90% emission reduction over Euro 6 targets, already among the most stringent emissions targets in the world.

The Commission is currently considering three options for Euro 7:

The Euro 7 regulations are expected to be finalized and promulgated later this year. Meantime, Reuters has reported that nine member states have written a joint letter to the EU Commission pressing for a date certain to ban ICEVs in the EU. The member states included: Austria, Belgium, Denmark, Greece, Ireland, Lithuania, Luxembourg and Malta.

Moreover, in addition to a ban date, tougher CO2 standards and expanded EV infrastructure investment, EU legislation should also be amended to allow countries to take national action to phase out new petrol and diesel cars. There is a legal question involved as to whether member states have the authority to ban cars, which is why nearly all member states that have announced bans have not actually legislated them. Transport Energy Outlook members can read about this in the recent monthly report on global car bans.

5. Green Car Congress: DOE Releases Analysis of Potential Impacts of Hyperloop Technology on the Grid – This article summarizes a recent report from the U.S. Department of Energy (DOE) on the impact of hyperloop technology to the power grid and to transportation in the U.S. In terms grid impacts, DOE found that energy and power demands of the system would be significant and would require mitigation strategies. The electrical energy required to support one moderately sized hyperloop system over a 24-hour period might be in the range of 500 to 600 MWh/day for passenger travel; and up to 1,900 MWh/day for heavier freight.

For hyperloop systems connected directly to the grid, the fluctuating power dynamics could present serious challenges for grid integration. DOE modeling found that the power factor, magnitude, short duration, frequency, and number of power pulses per day, both from the grid (for pod launch and acceleration) and back to the grid (during periods of regenerative braking), would induce unusual stresses throughout the grid.

What about transportation? The analysis also found that transporting passengers via hyperloop could result in 20% energy savings for passenger transport compared to other modes such as air or personal vehicle. These savings were calculated using the average fleet efficiency projected to 2030. Such energy savings would be less if compared to today’s “best in class” vehicles, or to a future fleet with higher vehicle utilization (i.e., passengers/vehicle) factors.

Hyperloop transport of freight could be less energy-efficient per ton-mile shipped than all other modes of freight transport, except for air. The study estimated that hyperloop freight transport would be 8 times less efficient than transport by water and rail, and at least 3 times less efficient than transport by truck.

Tammy Klein is a consultant and strategic advisor providing market and policy intelligence and analysis on transportation fuels to the auto and oil industries, governments, and NGOs. She writes and advises on petroleum fuels, biofuels, alternative fuels, automotive fuels, and fuels policy.