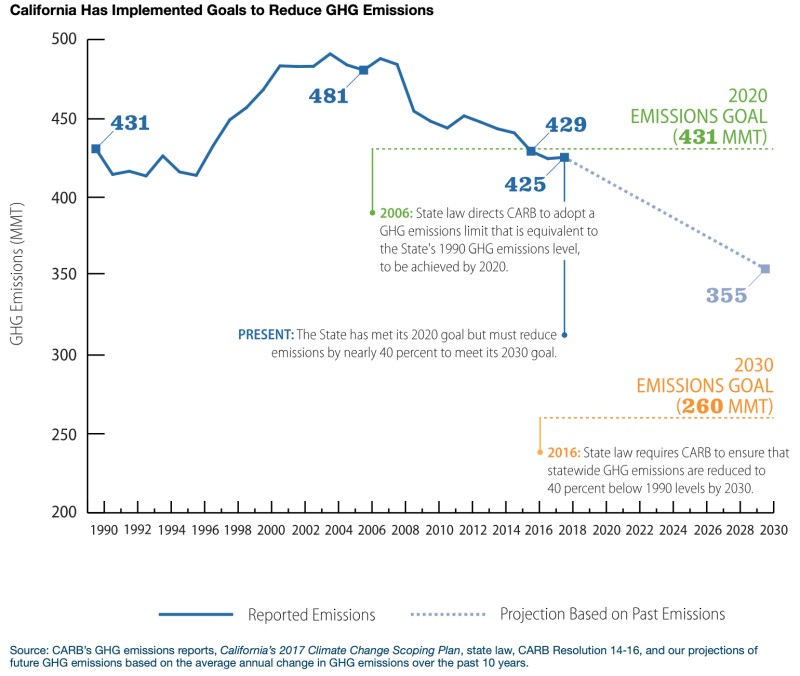

In response to a request from California’s Joint Legislative Audit Committee, the State Auditor recently completed an audit of the California Air Resources Board’s (CARB) GHG emission reduction programs for transportation. In summary, the auditor found that the state may not meet its 2030 40% GHG reduction goal and that CARB needs to do more to help the state meet its climate goals (represented in the figure below).

In a letter to the Audit Committee, the state auditor notes:

CARB has not done enough to measure the GHG emissions reductions its individual transportation programs achieve. Specifically, CARB has not collected or evaluated sufficient data to allow it to determine whether or how its incentive programs, which pay consumers in exchange for purchasing low- and zero-emission vehicles, reduce GHG emissions beyond what CARB’s regulations already require. For example, CARB has done little to measure the extent to which its incentive programs lead to emissions reductions by causing individuals and businesses to acquire clean vehicles that they otherwise would not. As a result, CARB has overstated the GHG emissions reductions its incentive programs have achieved, although it is unclear by how much. Given the ambitious nature of the State’s climate change goals and the short time frame to meet them, California is in need of more reliable tools with which to make funding decisions.

The audit further noted that the state’s cap-and-trade program “although substantial, cap‑and‑trade revenue is finite and can be unpredictable. Partly as a result of the ongoing COVID‑19 pandemic, the cap‑and‑trade auction in May 2020 generated quarterly proceeds of only $25 million, compared to an average of more than $700 million for each of the previous 11 quarters.”

With respect to CARB’s regulatory and incentive programs (for example, incentives to purchase ZEVs), the audit found that although CARB generally approaches the projected GHG reductions from its individual programs in a reasonable way, it has not accounted for overlap between some of its programs. The audit notes:

“For the eight regulatory programs we reviewed, we found that when proposing the new regulation, CARB generally identified the relationship between the regulation and other existing regulatory programs in order to isolate the expected additional GHG reductions. However, the proposed regulations did not assess how the regulatory programs might overlap with its incentive programs that work toward the same objective. Because CARB does not know whether funds for incentives will be available in the future to help manufacturers and consumers offset vehicle costs, CARB designs certain regulatory programs to achieve their GHG reductions without assistance from the incentive programs. Although reasonable, this approach means that the GHG reductions it claims from its incentive programs should be over and above what the regulatory programs achieve, and CARB must be able to measure those additional GHG reductions.”

Specifically, the audit was critical of the following:

The audit notes that CARB may be overstating the GHG emission reduction impact from its programs:

“One effect of this overstatement is to obscure the programs’ cost‑effectiveness in reducing GHG emissions. … Specifically, if the annual reports contained accurate information, these reports could better help the Legislature make decisions about whether to continue funding a given program at its current level, decrease the funding and use those resources elsewhere, or significantly increase funding. Further, improved and clear metrics will help CARB to know when its incentive programs have successfully achieved their goals of helping low‑ and zero‑emission vehicle technology become sustainable. As part of strengthening its program measurement overall, CARB must also do more to ensure that the data it collects on those programs are accurate and that the calculations CARB makes from the data are free of errors that can further distort the emissions reductions it reports.”

The auditor made several recommendations:

The audit report notes that CARB agreed with the recommendations and indicated that it is taking steps to implement them. CARB released a separate statement noting that:

The Auditor’s report underscores the need to double down on Advanced Clean Cars, clean trucks and incentive programs that ensure we meet our climate and air pollution goals and targets—we agree. Additionally, we expect emissions reductions moving forward will increase due to the Governor’s Zero-Emission by 2035 Executive Order that puts more pressure on the mobile source sector to reduce emissions.

Will CARB work to change this and shore up the issues identified by the audit? You know it. The gaps identified in the audit will be closed. Will other regulatory and/or incentive programs be proposed and implemented that will close the GHG emissions gap? Certainly, starting with the Advanced Clean Cars and Fleets programs as CARB indicates in its statement. It’s not too late to implement other programs to help meet the 2030 40% GHG emission reduction goal. In this respect, the audit kind of seems like a non-issue and something to let fade into the ether — which I would submit has happened. It’s not like the audit got much play in the media.

But on the other hand, this audit is a big deal. California is one of the most stringently regulated areas of the world when it comes to transport emissions with one of the most advanced and sophisticated regulatory regimes affecting fuels/energy sources and vehicles. And yet, according to the audit, CARB has not done enough to accurately measure the GHG reductions its regulatory and incentive programs are supposed to achieve (no one has mentioned “real-world” reductions?), it does not know what kind of socioeconomic benefits its programs may or may not be achieving, and it does not know how or whether its programs are shifting consumer behavior.

Think about that.

Think about the implications for industries involved in transport – from the third-party charging companies, the car companies to the oil refineries and many others – and the billions that have been spent on compliance. Think about the implications for communities, and for the taxpayers that are footing the bill in various ways. And finally think about this: the audit says that CARB needs to do more to meet GHG goals, but think of the many actions the Agency has already taken. Yet, it is not enough. If it’s difficult for CARB, think about how difficult it will be for other jurisdictions globally looking to reduce GHG emissions in the transport sector.

Tammy Klein is a consultant and strategic advisor providing market and policy intelligence and analysis on transportation fuels to the auto and oil industries, governments, and NGOs. She writes and advises on petroleum fuels, biofuels, alternative fuels, automotive fuels, and fuels policy.